Discover the secret Forex strategies used by successful traders worldwide to maximize profits and minimize risks in the market.

Image courtesy of via DALL-E 3

Image courtesy of via DALL-E 3

Table of Contents

Introduction to Forex Trading

Forex trading, also known as currency trading, is a way for people to exchange different types of money with each other. It’s like swapping your toy for a friend’s toy, but instead of toys, it involves trading currencies from different countries.

Imagine you have a dollar and you want to exchange it for a euro because you’re going on a trip to Europe. Forex trading allows you to do just that – exchange your dollar for a euro at the current exchange rate.

People trade currencies in the Forex market to make a profit by buying low and selling high. It’s like buying a toy for a low price and selling it for a higher price to make some extra money.

Understanding the Forex Market

Forex trading is all about exchanging different types of money with each other. But where does this trading happen? It takes place in the Forex market, a bustling hub where people and companies from all over the world buy and sell currencies. Imagine it like a big shop for currencies, where you can trade your dollars for euros or yen for pounds.

What is the Forex Market?

The Forex market is like a giant marketplace where currencies are bought and sold. It’s open 24 hours a day, five days a week, except on weekends. This means that people can trade currencies at any time, day or night. The market never sleeps, allowing traders from different time zones to participate whenever they want.

Why Do People Use the Forex Market?

There are many reasons why people use the Forex market. Some may need to exchange money for travel to another country, while others might trade currencies for business purposes. For example, a company that imports goods from Europe may need to buy euros to pay for their purchases. By using the Forex market, they can easily exchange their currency for the one they need.

The Basics of Trading Strategies

In this section, we’ll talk about the plans or rules that people use to decide when to buy or sell currencies to try to make money.

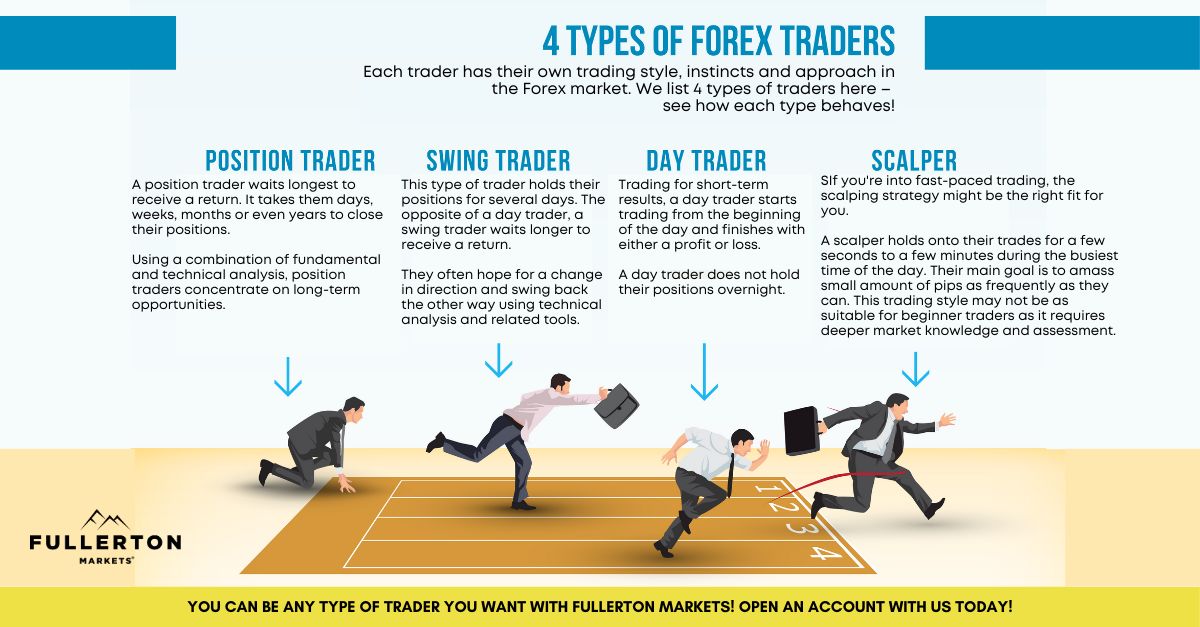

Image courtesy of www.fullertonmarkets.com via Google Images

What is a Trading Strategy?

We will explain what a trading strategy is, like a secret plan for trying to win a game. Just like in a game where you have to follow certain rules to score points, in Forex trading, people have strategies that help them decide when to buy or sell currencies to make a profit.

Examples of Simple Trading Strategies

We’ll give some easy examples of trading strategies that people might use in the Forex market. For example, some traders might use a strategy called “trend following,” where they buy a currency when its price is going up and sell it when it’s going down. Others might use a strategy called “range trading,” where they buy a currency when it’s at a low price and sell it when it reaches a high price within a certain range. These strategies help traders make decisions based on specific rules rather than guessing randomly.

Making Sense of Technical Analysis

When it comes to trading currencies in the Forex market, many people rely on a method called technical analysis to help them make decisions. Technical analysis is like using clues from charts and patterns to try to figure out what might happen next with currency prices. It’s kind of like looking at a weather map to predict if it’s going to rain or be sunny.

What is Technical Analysis?

Technical analysis is a way of studying past price movements on charts to try to predict future price movements. Traders look for patterns and trends in the data to help them make decisions about when to buy or sell currencies. It’s a bit like trying to solve a puzzle by looking at all the pieces and figuring out how they fit together.

Basic Tools of Technical Analysis

There are some simple tools that traders use to do technical analysis. One common tool is drawing lines on charts to connect highs and lows of price movements. These lines can help traders see where prices might go next. Another tool is looking for shapes in the charts, like triangles or rectangles, that can give clues about what might happen with prices. By using these tools, traders can try to make sense of the patterns in the data and make informed decisions about their trades.

Leverage in Forex: A Double-Edged Sword

In the world of Forex trading, leverage is a powerful tool that can magnify both gains and losses. Imagine using a seesaw to lift something heavy – leverage works in a similar way, allowing traders to control a larger position with a smaller amount of their own money. Let’s delve into what leverage is and why it can be risky.

Image courtesy of traderoomplus.com via Google Images

Image courtesy of traderoomplus.com via Google Images

What is Leverage?

Leverage is like borrowing money from your broker to make trades. For example, with a leverage ratio of 50:1, you can control a $50,000 trade with just $1,000 of your own money. This amplifies the potential profit you can make, but it also increases the risk of losing more than your initial investment.

The Risks of Using Leverage

While leverage can lead to substantial gains, it also comes with significant risks. Just as riding a fast bike can be thrilling but dangerous, trading with leverage can result in big wins or big losses. If the market moves against your position, the losses can exceed your initial investment, leading to a margin call where you may need to deposit more money to cover the losses.

Conclusion

In this blog post, we’ve covered the basics of Forex trading, from understanding the Forex market to exploring trading strategies, technical analysis, and the concept of leverage. Let’s recap what we’ve learned:

Forex Trading and Currency Exchange

We learned that Forex trading is a way to exchange different types of money with each other. It’s like going to a big shop where you can buy and sell currencies.

The Forex Market

The Forex market is where people and companies trade currencies. It’s open 24 hours a day, five days a week, allowing traders to participate at any time.

Trading Strategies

Trading strategies are plans or rules that traders use to decide when to buy or sell currencies. It’s like having a secret plan to try to win a game.

Technical Analysis

Technical analysis involves using charts and patterns to predict currency price movements. It’s similar to looking at a weather map to forecast the weather.

Leverage in Forex Trading

Leverage allows traders to control larger positions with a smaller amount of capital. While it can lead to big wins, it also comes with significant risks, similar to riding a fast bike.

By understanding these key concepts, traders can navigate the Forex market more effectively and make informed decisions. Remember, Forex trading requires caution and careful planning to mitigate risks and maximize potential profits. Whether you’re trading for travel, business, or investment purposes, always approach the market with a clear strategy and a disciplined mindset.

FAQs

Can kids trade in the Forex market?

We’ll explain if kids can participate in Forex trading or if it’s just for grown-ups.

Is Forex trading like playing a video game?

We’ll talk about how Forex trading can seem like a game because it involves strategies and winning or losing, but it’s really a serious kind of business.