Discover the secrets to long-term investing success and how you can maximize your gains for a secure financial future.

Table of Contents

- Introduction to Long-Term Investments

- Building Your Investment Treehouse

- Tools to Help Your Investments

- Staying Safe on the Investing Playground

- Being a Patient Investor

- Growing Bigger with Compound Interest

- Setting Your Investment Goals

- Diversifying Your Investment Basket

- Checking on Your Investments

- Conclusion: Your Future as a Smart Investor

- FAQs

Introduction to Long-Term Investments

We’ll begin with understanding what long-term investments mean and why they are important for growing your lemonade stand money over many summers.

What Are Long-Term Investments?

Long-term investments are like saving up for something big, like a super cool bike or a video game console. Instead of spending all your money right away, you put it into something that will grow over time, just like planting seeds and watching them grow into tall trees.

Why Think Long-Term?

Being patient with your money and letting it grow over a long time can help you have more money in the future. It’s like planting a tree and waiting for it to grow big and give you lots of fruits. Long-term investments can help your money grow into a bigger pile of cash, so you can buy even cooler things in the future.

Building Your Investment Treehouse

Imagine you want to build an awesome treehouse in your backyard. You wouldn’t just start hammering wood together randomly, right? You’d probably draw up some plans to make sure your treehouse is strong and sturdy. Well, creating a money plan for your investments is a lot like that.

When you are thinking about where to put your money, it’s important to have a plan. Just like a treehouse needs a solid foundation and good support beams, your investments need a strategy to grow strong over time. This is where a personalized trading strategies generator can come in handy. It helps you come up with a plan that fits your goals and helps your money grow.

Tools to Help Your Investments

When it comes to making smart investment decisions, there are tools that can help you along the way. These tools are like having a trusty map and compass to navigate the investment world. Let’s take a look at some of these helpful resources that experts use to maximize gains and minimize risks.

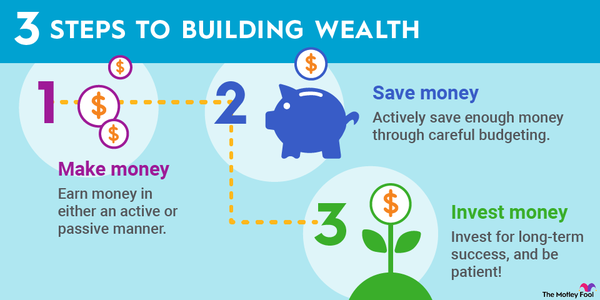

Image courtesy of www.fool.com via Google Images

Using Signals to Make Choices

Imagine you have a magical crystal ball that can give you hints about where to find hidden treasure. Well, trading signals work in a similar way. They provide you with valuable information about when it might be a good time to buy or sell investments. These signals are like clues that can guide you in making decisions that have the potential to grow your money.

Understanding the Market

Have you ever been to a big store where everyone is buying and selling things? Well, the market is like a gigantic version of that. In the investment world, the market is where stocks, bonds, and other assets are traded. By using real-time market analysis tools, you can get a better understanding of what’s happening in the market and make informed choices about where to put your money.

Staying Safe on the Investing Playground

Investing can be like playing on a playground – fun, exciting, but also full of risks. Just like you follow playground rules to stay safe, you need to understand how to keep your money safe while investing. Let’s explore some tools and strategies to help you navigate the investing playground wisely.

Calculating Risks

Before you hop onto any investment ride, it’s essential to know how risky it might be. Think of a risk assessment calculator as your helmet on the playground – it protects your head from potential falls. This calculator helps you measure the level of risk involved in an investment so you can make informed decisions. Just like you wouldn’t jump off the monkey bars without checking the height, you shouldn’t invest without understanding the risks.

Managing Risks

Imagine having super cool gadgets to help you stay safe on the playground – that’s what advanced risk management software does for investors. It acts as your safety net, helping you protect your money when the investing weather turns stormy. This software provides tools and strategies to minimize risks and safeguard your investments. It’s like having a superhero cape that shields you from financial harm.

Being a Patient Investor

Understanding why waiting and being patient with your investments is like waiting for your trees to grow bigger for more treehouse wood.

Image courtesy of venngage.com via Google Images

Image courtesy of venngage.com via Google Images

The Power of Patience

Being patient means waiting calmly without getting mad or worried. When you’re a patient investor, you don’t rush to make quick decisions with your money. Just like watching a seed grow into a big tree, waiting for your investments to grow can make them bigger and stronger. It’s like magic, but really it’s the power of time and patience working together.

| Investment Option | Potential Gain | Risk Level | Time Horizon |

|---|---|---|---|

| S&P 500 Index Fund | 8-10% annually | Medium | 5+ years |

| Real Estate Investment Trusts (REITs) | 6-8% annually | Low to Medium | 5-10 years |

| Dividend-Paying Stocks | 5-7% annually | Medium | 5+ years |

| Bonds | 3-5% annually | Low | 1-5 years |

Growing Bigger with Compound Interest

compound interest is like a magical money tree that keeps growing bigger and bigger. When you save money in a bank or invest it, you earn interest. But with compound interest, you not only earn interest on the money you put in initially but also on the interest you’ve already earned. It’s like planting one apple seed and watching it grow into a tree full of apples.

Setting Your Investment Goals

Talking about how to decide what you want to do with your money in the future, like saving for a college superhero course or a trip to the moon.

Image courtesy of www.visualcapitalist.com via Google Images

Image courtesy of www.visualcapitalist.com via Google Images

Choosing Your Money Adventures

Have you ever thought about what you want to do with your money when you grow up? Maybe you dream of becoming a superhero scientist at college or going on a thrilling trip to the moon. Setting your investment goals is like creating a treasure map that leads you to those big dreams.

Diversifying Your Investment Basket

When it comes to investing your lemonade stand money, it’s important to remember the saying, “Don’t put all your eggs in one basket.” In the world of investments, this means diversifying your investment basket. But what does that really mean?

Why Not Put All Eggs in One Basket?

Imagine you have a basket filled with different types of candies – some chocolates, some gummies, and some lollipops. If you accidentally drop the basket and all the candies spill out, you’ll still have some left of each kind. This is similar to investing. Instead of putting all your money into just one type of investment, like only buying chocolate candies, it’s smarter to spread your money across different types, just like having a variety of candies in your basket.

Checking on Your Investments

When you put your money into investments, it’s like planting seeds in a garden. You want to make sure those seeds are growing into healthy plants that will give you a bountiful harvest. To ensure your investments are on the right track, you need to check on them from time to time.

Image courtesy of advisor.visualcapitalist.com via Google Images

Image courtesy of advisor.visualcapitalist.com via Google Images

Regular Check-ups for Your Money

Just like you wouldn’t ignore a sprouting plant in your garden, you shouldn’t ignore your investments. It’s essential to regularly check how your investments are doing. You can look at how much they’ve grown, compare them to your initial investment, and see if they’re following your money plan!

Monitoring your investments helps you stay informed about any changes. You can see if they’re growing as expected or if they need some adjustments. It’s like keeping an eye on a batch of cookies in the oven to make sure they’re baking perfectly.

Conclusion: Your Future as a Smart Investor

Throughout this adventure into the world of long-term investing, you’ve learned valuable lessons that will help you become a savvy investor. By understanding the importance of thinking long-term, crafting a solid money plan, utilizing helpful tools, managing risks, and being patient with your investments, you’re on the right path towards building a bright financial future.

Just like saving up for a super cool bike or a video game console, investing your money wisely can lead to even greater rewards down the road. With personalized trading strategies, profitable signals, real-time market analysis, risk assessment calculators, and advanced risk management software at your disposal, you have the tools to make informed decisions and safeguard your investments.

Remember, growing your wealth is like tending to a treehouse. It takes time, patience, and careful planning to see it reach new heights. By embracing the power of compound interest, setting clear investment goals, diversifying your portfolio, and regularly monitoring your investments, you’re setting yourself up for success in the financial playground.

As you continue on your journey as a smart investor, keep learning, exploring, and adapting to the ever-changing landscape of the market. Whether you’re saving for a college superhero course or a trip to the moon, your dedication to making sound financial choices will pay off in the long run.

So, step boldly into the world of investments armed with knowledge, patience, and a strategic plan. Your future as a smart investor is bright, and with the right mindset and tools, you’re well-equipped to navigate the twists and turns of the financial world with confidence and success.

FAQs

Can kids invest too?

Yes, kids can start learning about investments too! Just like how you save up your allowance to buy something you really want, investing is like saving your money in different ways so it can grow over time.

How much money do I need to start investing?

You don’t need a lot of money to start investing. In fact, you can start small with whatever money you have saved up. It’s more about learning how to make smart choices with your money and watching it grow over time.

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

Image courtesy of Ivan Babydov via

Image courtesy of Ivan Babydov via