Unlock the secret to profitable trading with these 5 essential keys to success using powerful trading signals. Don’t miss out!

Table of Contents

- Introduction: Jumping into Profit with Trading Signals

- Understanding Trading Signals

- Playing It Safe with Advanced Risk Management

- Making It Yours with Personalized Trading Strategies

- Finding the Best Options with Strategies Optimizer

- Reading the Charts Like a Pro

- The Magic of Automated Trading

- Blending It All Together

- Smart Tips for Young Traders

- Conclusion: You’re Ready to Trade!

- FAQs

Introduction: Jumping into Profit with Trading Signals

We kick off by explaining what trading signals are and why they are important for making money in the trading world.

Understanding Trading Signals

Trading signals are like clues in a treasure hunt that help traders know when to buy or sell stocks, currencies, or other assets. These signals are generated by experts who analyze the market and provide valuable insights to traders.

What Are Trading Signals?

Imagine you’re playing a video game and a helpful guide pops up to tell you the best move to make next. Trading signals work in a similar way by giving traders recommendations on when to make a trade based on market conditions.

Choosing a Profitable Signals Provider

Not all trading signal providers are created equal. It’s important to choose a provider who has a track record of success and can offer signals that lead to profitable trades. Look for providers who have a history of accurate predictions and good recommendations.

Playing It Safe with Advanced Risk Management

risk management in trading is like wearing a helmet while riding a bike – it keeps you safe. When you trade, there’s a chance you could lose money. But by managing risks, you can protect your hard-earned cash. It’s all about being smart and careful with your moves.

Image courtesy of www.pinterest.com via Google Images

How Software Helps

Imagine having a super-smart friend who is always looking out for you. That’s what risk management software does for traders. It uses fancy algorithms to analyze the risks and make sure you don’t take big losses. It’s like having a guardian angel watching over your money.

Making It Yours with Personalized Trading Strategies

In trading, having a personalized approach can make all the difference. By crafting your own trading strategies, you can tailor your plan to suit your style and preferences. Let’s dive into the world of personalized trading strategies and how they can help you succeed in the trading game.

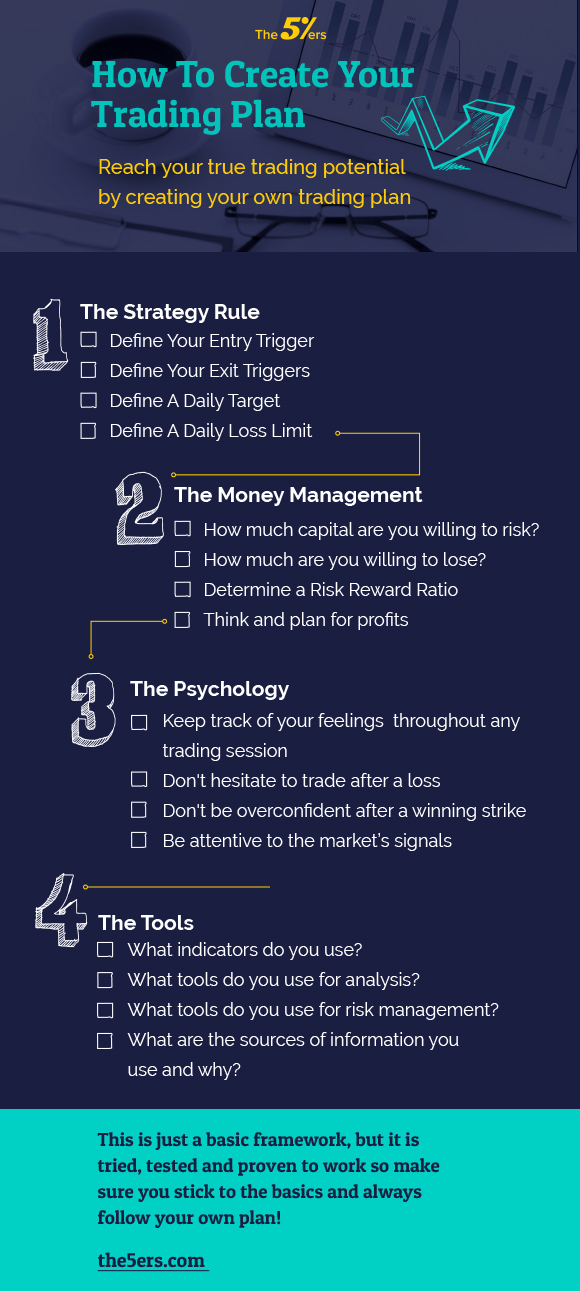

Crafting Your Own Trading Plan

Imagine trading like playing your favorite game, but instead of following someone else’s rules, you get to create your own. That’s the beauty of crafting your own trading plan. You can set your goals, define your risk tolerance, and choose strategies that resonate with you. It’s like customizing your gaming experience to suit your preferences.

Using a Strategies Generator

If you’re not sure where to start or looking for new ideas, a strategies generator can be a helpful tool. Just like a game suggesting different strategies based on your gameplay style, a strategies generator offers personalized suggestions tailored to your trading preferences. It can provide fresh insights and unique strategies that you may not have considered, enhancing your trading experience.

Finding the Best Options with Strategies Optimizer

options trading opens up a whole new world of possibilities in the exciting game of trading. It’s like having different strategies to choose from, much like picking your next move in a game. Let’s dive into the world of options trading and discover how you can level up your trading skills with the help of a strategies optimizer.

Image courtesy of in.pinterest.com via Google Images

Image courtesy of in.pinterest.com via Google Images

What is Options Trading?

Imagine you have a special power that allows you to choose different paths in a game, each leading to different outcomes. That’s what options trading is like. It gives you the flexibility to decide whether to buy or sell an asset at a specific price within a set period. It’s all about making the best move at the right time.

Optimizing Your Moves

Now, imagine you have a wise old wizard who guides you on the best moves to make in the game. That’s what a strategies optimizer does for your options trading. It uses advanced algorithms to analyze data and help you make super smart decisions. The optimizer considers various factors like market trends, risk tolerance, and your goals to suggest the most profitable strategies.

Reading the Charts Like a Pro

Charts in trading are like following a treasure map to find where the treasure moves. Just like a pirate searching for hidden gold, traders use charts to track the movements of prices in the trading world. These charts show us important information about the past and present prices of assets, helping us make decisions on when to buy or sell.

Charts for Crypto Explorers

For those trading digital currencies like Bitcoin, understanding charts is crucial. Cryptocurrency traders rely heavily on technical analysis charts to navigate the ups and downs of the volatile crypto market. These charts display price patterns, trends, and other important data that can guide traders in making informed decisions.

The Magic of Automated Trading

Imagine having a robot friend who can help you trade in the world of stocks and investments. That’s the magic of automated trading! These robot helpers, also known as algorithms, can make trades for us automatically, saving us time and effort.

Image courtesy of sureshotfx.com via Google Images

Image courtesy of sureshotfx.com via Google Images

Trading with Robot Helpers

When we talk about trading with robot helpers, we mean using algorithms that are programmed to make trades on our behalf. These algorithms follow specific rules and instructions set by traders to execute trades when certain conditions are met. This automated process can help traders take advantage of opportunities in the market even when they are not actively monitoring it.

Setting Up Your Trading Bot

To set up your trading bot, you first need to choose a trading platform that offers automated trading solutions. Then, you can program your bot with the specific rules and strategies you want it to follow. For example, you can tell your bot to buy a certain stock when its price reaches a certain level or to sell a currency pair when a particular indicator gives a signal.

| Key | Description |

|---|---|

| 1 | Choose a reliable signal provider: Look for a trading signals provider with a proven track record of accuracy and success. |

| 2 | Understand the signals: Take the time to learn how to interpret the signals provided and understand the reasoning behind them. |

| 3 | Practice risk management: Use proper risk management techniques to protect your capital and minimize losses. |

| 4 | Stay disciplined: Stick to your trading plan and avoid making impulsive decisions based on emotions. |

| 5 | Monitor your progress: Regularly review your trading performance and adjust your strategies as needed. |

Once your bot is set up, it will continuously monitor the market for opportunities based on the rules you’ve defined. This can help you stay disciplined in your trading approach and avoid making emotional decisions that could lead to losses.

With automated trading, you can take advantage of trading opportunities 24/7 without having to sit in front of a computer screen all day. It’s like having a robot friend who works tirelessly to help you make smart trading decisions.

Blending It All Together

Now that you’ve learned about trading signals, risk management, personalized strategies, options trading, technical analysis charts, and automated trading, it’s time to blend them all together to take your trading game to the next level.

Imagine you are a master chef in the kitchen, combining different ingredients to create the perfect dish. In trading, you can mix signals, strategies, risk management, and automation like a recipe to achieve success.

Start by using profitable trading signals to know when to make your moves. Then, implement advanced risk management software to protect your money and minimize losses. Next, craft personalized trading strategies that suit your style and goals.

When diving into options trading, optimize your strategies to make the best possible decisions. Utilize technical analysis charts to understand market trends and make informed choices, especially when dealing with cryptocurrencies.

Finally, consider using algorithmic trading automation solutions to automate your trades and save time. By blending all these tools and strategies, you can create your ultimate trading mix that maximizes your chances of success.

Just like a skilled chef combines different flavors to create a delicious meal, you can blend trading signals, risk management, personalized strategies, options trading, technical analysis charts, and automation to create a winning trading recipe.

Smart Tips for Young Traders

When you’re just starting out as a young trader, there are some important things to keep in mind to help you along the way. Think of these as the rules of the trading game.

Image courtesy of the5ers.com via Google Images

Image courtesy of the5ers.com via Google Images

Do:

– Start small: It’s best to begin with a small amount of money until you get the hang of things.

– Research: Always do your research before making any trades. Knowledge is power in the trading world.

– Practice patience: Remember, trading is a marathon, not a sprint. Be patient and stay focused on your goals.

Don’t:

– Let emotions rule: Trading can be exciting, but it’s essential not to let emotions like fear or greed dictate your decisions.

– Chase losses: If a trade doesn’t go your way, it’s best to cut your losses and move on instead of trying to win it back quickly.

– Neglect risk management: Protecting your money should be a priority. Make sure to use risk management strategies to keep your funds safe.

By following these do’s and don’ts, you’ll be on your way to becoming a smart and successful young trader in no time!

Conclusion: You’re Ready to Trade!

After exploring the exciting world of trading signals and strategies, you are now equipped with the knowledge and tools to begin your trading journey. Let’s quickly recap what we’ve learned and highlight the key points to remember as you step into the trading arena.

Getting Started with Trading Signals

Trading signals are like secret messages that tell you when to make a move in the trading game. Choosing a profitable signals provider is crucial to ensure you receive accurate and timely signals to guide your decisions.

Playing It Safe with Risk Management

Risk management is all about protecting your money while playing the trading game. Using advanced software can help you make smart decisions to safeguard your funds and avoid big losses.

Crafting Personalized Trading Strategies

Creating your own trading plan is like designing a strategy for a game that matches your style and preferences. Utilizing a strategies generator can offer you cool suggestions to enhance your trading experience.

Exploring Options Trading Strategies

Options trading opens up a world of possibilities for traders. Be sure to understand the game of options trading and use an optimizer to make the best moves in this exciting arena.

Reading Charts Like a Pro

Charts are like treasure maps that guide you through the ups and downs of trading. Understanding technical analysis charts, especially in the world of cryptocurrencies, can help you make informed decisions.

The Magic of Automated Trading

Automated trading with algorithmic solutions is like having a robot friend that helps you execute trades efficiently. By setting up your trading bot, you can save time and focus on other aspects of your trading journey.

Blending It All Together

By combining all the tools and strategies we’ve discussed, you can create the ultimate trading mix to level up your game. Signals, strategies, risk management, and automation, when blended wisely, can lead to successful trading ventures.

Remember, as you embark on your trading adventure, always keep in mind the smart tips we shared for young traders. Follow the do’s and don’ts like you would in any game’s rulebook to stay on the path to success.

With a strong understanding of trading signals, risk management, personalized strategies, chart analysis, automated solutions, and a blend of all these elements, you are now ready to trade with confidence and embark on an exciting journey in the world of trading!

FAQs

What are trading signals?

Trading signals are like helpful clues that tell you when it’s a good time to buy or sell something in the trading world. It’s like having a secret map that guides you in making smart decisions!

Can I use software to help me trade?

Absolutely! You can use special software tools to keep your money safe while trading. These tools can help you make wise choices and protect your hard-earned money from getting lost.

What does ‘optimize’ mean in trading?

When we say ‘optimize’ in trading, it’s like making your moves in a game even better. By using optimization tools, you can refine your strategies and make smarter decisions to win big in the trading game!

Are charts important for trading?

Yes, charts are super important in trading. They help you see the ups and downs in the trading world and understand what’s happening. It’s like having a magical map that guides you through the twists and turns of trading!

What is automated trading?

Automated trading is like having a robot friend that helps you make trades without you having to do all the work. These robot helpers (algorithms) can trade for you, saving you time and effort so you can focus on other fun things!

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

Image courtesy of Asiama Junior via

Image courtesy of Asiama Junior via