Unlock the secrets to successful swing trading with these essential tips that will take your trading game to the next level.

Table of Contents

- Introduction to Swing Trading

- Swing Trading Tools

- Understanding Trading Strategies

- Analyzing Market Trends

- Choosing the Right Stocks

- Crunching Numbers with Technical Analysis

- Setting up Your Trading Routine

- Managing Risks

- Practicing with Simulations

- Reviewing Your Trades

- Recap: Swinging to Success

- FAQs

Introduction to Swing Trading

Are you ready to dive into the exciting world of swing trading? Imagine yourself as a master strategist in a video game, carefully planning your moves to outwit your opponents and emerge victorious. Well, swing trading is quite similar! In this blog post, we will walk you through the basics of swing trading and why it’s a thrilling way to engage with stocks.

What is Swing Trading?

Swing trading is like trying to hit a home run in baseball. Just as a baseball player times their swing perfectly to send the ball flying out of the park, swing traders buy and sell stocks at strategic moments to capture short- to medium-term gains. It’s all about making smart decisions on when to enter and exit trades to maximize profits.

Why Swing Trading is Popular

Many people are drawn to swing trading because it offers a fast-paced and dynamic way to interact with the financial markets. It’s like solving a puzzle where you need to analyze trends, patterns, and signals to predict the best time to make your moves. With the potential to earn money quickly, swing trading appeals to those who enjoy the thrill of navigating the unpredictable world of stocks.

Swing Trading Tools

Tech can be super helpful, and just like in your favorite video game, using the right tools in swing trading can give you a big advantage.

Swing Trade Like a Pro: Essential Tips

Cool Tech for Swing Traders

Imagine having special tools that can help you make better decisions when trading stocks. Just like how you might use a magnifying glass to find hidden clues in a detective game, swing traders use tools to uncover important information about stocks. These tools can show you patterns in stock prices, trends in the market, and even give you hints on when to buy or sell. It’s like having a cheat code in a video game that helps you level up faster!

Must-Have Trading Platforms

Think of trading platforms as the playground where you practice your trading skills. Just like how you might use a learning app for school subjects, trading platforms are like special apps that help you buy and sell stocks easily. These platforms usually have charts, graphs, and other tools to analyze stock prices and trends. Some platforms are perfect for beginners because they’re user-friendly and designed to help you learn as you trade. It’s like having a trusty sidekick in a video game who guides you through the adventure!

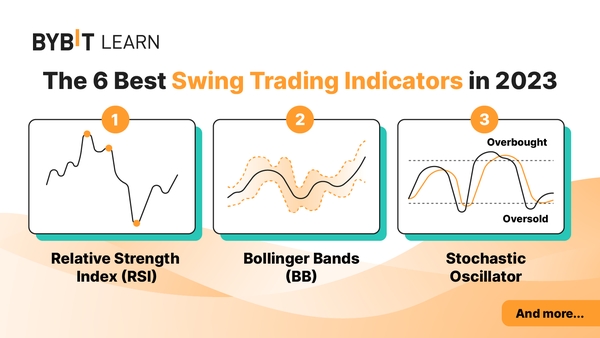

Understanding Trading Strategies

Imagine having a secret plan that helps you win; swing trading strategies are just like that. They’re your game plan for success!

Image courtesy of learn.bybit.com via Google Images

Building Your Game Plan

Learn how to come up with a trading strategy that fits you, just like choosing the right character in a game.

Using ProTradingAssistant

Discover how ProTradingAssistant can be like a cheat code to help you make better trading decisions.

Analyzing Market Trends

Understanding the market is like knowing the weather before you go outside to play. We’ll show you how to figure out the trading weather!

Reading the Market

Learn how to read the market trends, which is like reading a secret map that shows you where the treasure is hidden.

Just like how you check the weather forecast before planning a day out, analyzing market trends helps you see which way the stock market might move. By studying patterns and changes in prices, you can get an idea of whether a stock might go up or down. It’s like having a crystal ball to predict the future of a company’s stock!

Market trends can give you valuable clues on when to buy or sell a stock. For example, if you notice that a particular stock has been consistently rising in price over a period of time, it might be a good time to buy before it goes even higher. On the other hand, if a stock’s price has been falling consistently, you might want to sell before it drops further.

By paying close attention to market trends and analyzing the data, you can make smarter decisions about when to make your moves in the stock market. It’s like having insider information that can help you stay ahead of the game!

Now that you know the importance of analyzing market trends, let’s move on to the next step in becoming a successful swing trader!

Choosing the Right Stocks

Choosing stocks is like picking players for a team. You want the ones that will work the best for you. Let’s learn how to pick winners!

Image courtesy of www.fool.com via Google Images

Image courtesy of www.fool.com via Google Images

Finding Signals

Signals can show you which stocks might be winners, kind of like a treasure hunt where the clues lead you to gold.

When you’re picking stocks to buy or sell, it’s important to pay attention to signals. These signals can come from various sources like market trends, company news, or even expert recommendations. By analyzing these signals, you can make informed decisions about which stocks to invest in.

For example, if a company releases a positive earnings report, it could be a signal that their stock price might go up. On the other hand, negative news like a product recall could signal a drop in stock value. Keeping an eye on these signals can help you make smart choices in the stock market.

Just like in a video game where you pay attention to power-ups and clues to advance to the next level, paying attention to signals in the stock market can give you an edge in your trading strategy.

Crunching Numbers with Technical Analysis

Technical analysis is like doing homework for stocks – it can be a bit tough, but it really helps you understand what might happen next! When you crunch numbers with technical analysis, you’re basically using tools and charts to predict how a stock might move in the future.

Charting Your Path

Charts can look like secret codes, but they’re really just a way of tracking what stocks are doing, kind of like a scorecard in sports. By looking at these charts, you can see patterns and trends that can give you clues about whether a stock might go up or down in price.

Setting up Your Trading Routine

Just like you have a routine for school or chores, setting up a trading routine can help you stay on top of your game and make sure you’re doing your best.

Image courtesy of in.pinterest.com via Google Images

Image courtesy of in.pinterest.com via Google Images

Daily Trading Habits

We’ll talk about the healthy habits you can create, so your swing trading is as smooth as brushing your teeth. Just like how you brush your teeth every morning and night, having a routine for trading can help you keep track of your trades, analyze your strategies, and make smart decisions.

Managing Risks

Just like wearing a helmet when you bike, managing risks in trading helps you stay safe and keep having fun. It’s important to understand how to protect yourself and your money while playing the trading game.

Staying Safe While Trading

When you’re trading, there are some important things to keep in mind to protect yourself:

| Tips | Description |

|---|---|

| 1. Set clear entry and exit points | Determine your target prices before entering a trade to avoid emotional decisions. Stick to your plan. |

| 2. Use technical indicators | Utilize tools like moving averages, RSI, and MACD to identify potential trading opportunities. |

| 3. Manage risk effectively | Set stop-loss orders to limit potential losses and always calculate your risk-to-reward ratio. |

| 4. Stay informed about market news | Keep abreast of economic events and market developments that could impact your trades. |

| 5. Practice patience and discipline | Avoid impulsive trading decisions and stick to your strategy even during volatile market conditions. |

1. Do Your Research: Before you make any trades, make sure you do your homework. Understand the stocks you’re buying and the market trends. Knowledge is your best tool for staying safe.

2. Set Limits: Decide how much you’re willing to risk before you start trading. Setting limits on how much you’re willing to lose can help prevent you from making impulsive decisions that could hurt your wallet.

3. Diversify Your Portfolio: Don’t put all your eggs in one basket. By spreading your investments across different types of stocks, you decrease the risk of losing all your money if one stock doesn’t perform well.

4. Use Stop-Loss Orders: A stop-loss order is like a safety net for your investments. It automatically sells your stock if the price drops below a certain level, limiting your losses.

5. Avoid Overtrading: Don’t get caught up in the excitement and trade too frequently. Overtrading can increase your risk and lead to unnecessary losses.

By following these tips and staying informed about the market, you can manage the risks associated with trading and keep yourself safe while playing the trading game.

Practicing with Simulations

Before jumping into the real trading game, it’s important to practice with simulations. Think of it as playing the tutorial level in a video game to get a feel for how things work without any risk involved. Simulations are like your training ground, where you can make mistakes and learn without losing any real money.

Image courtesy of www.investors.com via Google Images

Image courtesy of www.investors.com via Google Images

Trading Games and Simulators

trading games and simulators are like virtual playgrounds where you can test out your trading strategies in a risk-free environment. Just like playing a flight simulator before becoming a real pilot, these tools allow you to experience the ups and downs of the market without any financial consequences. You can practice buying and selling stocks, analyzing market trends, and honing your skills without putting your hard-earned money on the line.

Reviewing Your Trades

Just like after a sports game, looking at what you did can help you learn and become even better for next time.

Learning from Mistakes

We all make mistakes, and in trading, it’s okay! It’s part of the learning process. When you review your trades, take note of any mistakes you made and think about how you can avoid making the same mistakes in the future. Maybe you bought a stock at the wrong time or didn’t sell when you should have. By recognizing these errors, you can make better decisions next time.

Recap: Swinging to Success

So, you’ve learned a lot about swing trading, and now it’s time to recap all the exciting tips and strategies we’ve covered to help you swing to success in the stock market!

Image courtesy of tradingstrategyguides.com via Google Images

Image courtesy of tradingstrategyguides.com via Google Images

Introduction to Swing Trading

Swing trading is like hitting a home run in baseball – it’s all about timing when to buy and sell stocks to earn money. Many people love swing trading because it’s like solving a fast-paced puzzle that can help you make a profit.

Swing Trading Tools

Just like using cool gadgets and tools in your favorite video game, having the right tech in swing trading can give you a big advantage. Finding the best trading analytics platform for beginners and using an in-depth market trend analysis tool can make trading easier and more fun.

Understanding Trading Strategies

Swing trading strategies are like secret plans that help you win. They’re your game plan for success! By building a personalized trading strategy and using tools like ProTradingAssistant, you can make better trading decisions and increase your chances of success.

Analyzing Market Trends

Understanding market trends is like knowing the weather before you go outside to play. By reading the market trends, you can figure out the trading weather and make smarter choices in the stock market.

Choosing the Right Stocks

Choosing stocks is like picking players for a team. You want the ones that will work the best for you. By finding profitable trading signals, you can identify potential winners and build a strong trading portfolio.

Crunching Numbers with Technical Analysis

Technical analysis is like doing homework for stocks – it helps you understand what might happen next. By using technical analysis charts, you can track stock movements and make informed decisions in the market.

Setting up Your Trading Routine

Just like having a routine for school or chores, setting up a trading routine can help you stay on top of your game. By developing daily trading habits, you can ensure that your swing trading is as smooth as brushing your teeth.

Managing Risks

Managing risks in trading is essential for staying safe and having fun. By learning how to protect your money and stay safe while trading, you can minimize potential losses and maximize your profits.

Practicing with Simulations

Practicing with simulations is like playing the tutorial level before the real game. By using trading games and simulators, you can hone your skills and improve your trading strategies without any risk.

Reviewing Your Trades

Just like after a sports game, reviewing your trades can help you learn from your mistakes and improve for next time. By learning from your trading mistakes, you can become a better trader and increase your chances of success in the market.

FAQs

Common Questions About Swing Trading

Are you curious about swing trading but not sure where to start? Let’s dive into some common questions to help you gain a better understanding of this exciting trading strategy.

Q: What makes swing trading different from other types of trading?

A: Swing trading focuses on capturing short- to medium-term gains in a stock (or any financial instrument) over a period of a few days to several weeks. It’s different from day trading, where trades are executed within the same day, and long-term investing, which involves holding onto assets for years.

Q: How do I know which stocks to trade in swing trading?

A: Choosing the right stocks for swing trading involves looking for ones that exhibit price momentum and volatility, making them more likely to experience short-term price movements that swing traders can capitalize on. Some swing traders use technical analysis tools to identify such stocks.

Q: Can swing trading be profitable for beginners?

A: Yes, swing trading can be profitable for beginners who are willing to put in the time and effort to learn about the market and develop solid trading strategies. It’s essential to start small, manage risks effectively, and continually educate yourself to increase your chances of success.

Q: How do I manage risks while swing trading?

A: Risk management is crucial in swing trading to protect your capital from significant losses. Setting stop-loss orders, diversifying your trades, and avoiding emotional decision-making are some strategies that can help you manage risks effectively.

Q: Do I need a lot of money to start swing trading?

A: You don’t necessarily need a large amount of capital to start swing trading, but having enough funds to cover trading costs and potential losses is important. It’s recommended to start with an amount you can afford to lose and gradually increase your capital as you gain experience and confidence in your trading abilities.

Q: How can I stay informed about market trends and trading signals in swing trading?

A: Using tools like ProTradingAssistant and other trading analytics platforms can help you stay informed about market trends, trading signals, and potential opportunities in the market. These tools provide valuable insights and data that can assist you in making informed trading decisions.

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

Have more questions about swing trading? Feel free to reach out, and we’ll be happy to help you navigate the exciting world of swing trading!

Image courtesy of Anna Nekrashevich via

Image courtesy of Anna Nekrashevich via