Discover the key strategies to ensure your investments stand the test of time and secure your financial future.

Table of Contents

- Introduction: Why Longevity Matters in Investing

- What is a Long-Term Investment Portfolio?

- The Tools of the Trade

- Why Use a Risk Assessment Calculator?

- Understanding the Importance of Diversification

- The Role of Patience in Investing

- Learning from the Pros: Successful Investors

- Starting Young: The Power of Time

- Putting It All Together: Building Your Long-Term Portfolio

- Conclusion: Your Future as a Smart Investor

- Frequently Asked Questions (FAQs)

Introduction: Why Longevity Matters in Investing

Hey, young investors! Have you ever thought about making your money grow over a really long time? Well, that’s what we’re talking about today—it’s called investing for longevity!

What is a Long-Term Investment Portfolio?

A long-term investment portfolio is like a big box where you keep your money in different places so that it can grow over many years. It’s kind of like having a treasure chest where you store your coins and gems, except in this case, your treasure is money that you want to make more of!

The Tools of the Trade

To make smart decisions when investing for the long term, you need some special tools to help you navigate the complex world of finance. These tools act as your guides, helping you understand market trends, predict future stock movements, and provide valuable insights into the best investing strategies for beginners. Let’s explore the essential tools you need to optimize your long-term investment portfolio:

Image courtesy of www.fool.com via Google Images

Optimize Your Portfolio for Longevity

Getting to Know Market Trends

Trends are like clues that can help us understand what might happen next in the world of money. By using an in-depth market trend analysis tool, you can analyze patterns and developments in the market to make informed decisions about where to invest your money.

Forecasting the Future of Stocks

Forecasting involves making educated guesses about how the stock market will behave in the future. With the help of stock market trend forecasting software, you can predict potential market movements and adjust your investment strategy accordingly, similar to predicting the weather to plan your outdoor activities.

Starting Smart with Analytics Platforms

Analytics platforms are like cheat sheets for video games—they provide you with valuable insights, tips, and tricks to help you excel at investing. By utilizing the best trading analytics platform for beginners, you can access valuable information and expert guidance to make informed decisions and optimize your investment portfolio.

Minimizing Risks with Advanced Software

Investing can be risky, like trying a new skateboard trick. But with special software, it’s like wearing a helmet and knee pads to keep your money safe when it takes a tumble.

Why Use a Risk Assessment Calculator?

A risk assessment calculator is like a flashlight in the dark, showing you where the tricky parts are when dealing with stocks, so you don’t trip over them.

Why Use a Risk Assessment Calculator?

A risk assessment calculator can be a super helpful tool for anyone who wants to play the stock market game smartly. It’s like having a special marker that highlights where the risks are hidden so you can avoid them, just like how you might look out for rocks when skateboarding.

Risk Assessment Calculator for Stock Traders

Stock trading can be like a maze, full of twists and turns. With a risk assessment calculator, it’s like having a map that shows you the safest path to take, helping you navigate through the ups and downs of the stock market.

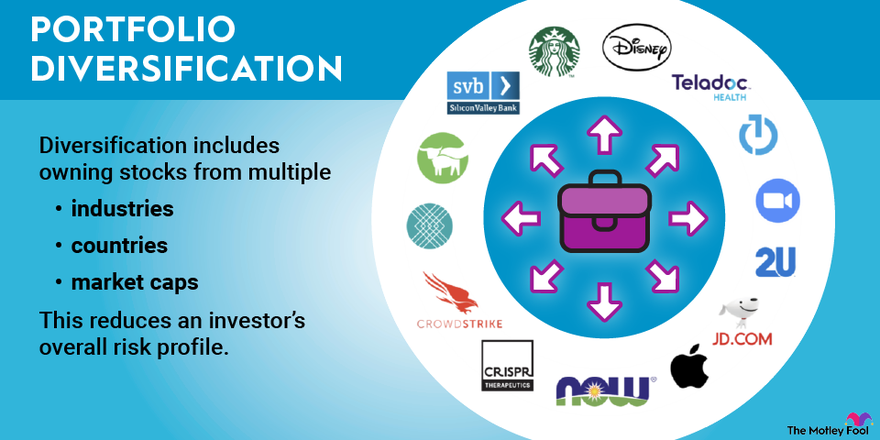

Understanding the Importance of Diversification

Imagine you have a basket full of eggs. If you put all your eggs in one basket and that basket falls, all your eggs will break. That’s why it’s important to not put all your money in one place when you’re investing. This idea is called diversification.

Image courtesy of profiletree.com via Google Images

Image courtesy of profiletree.com via Google Images

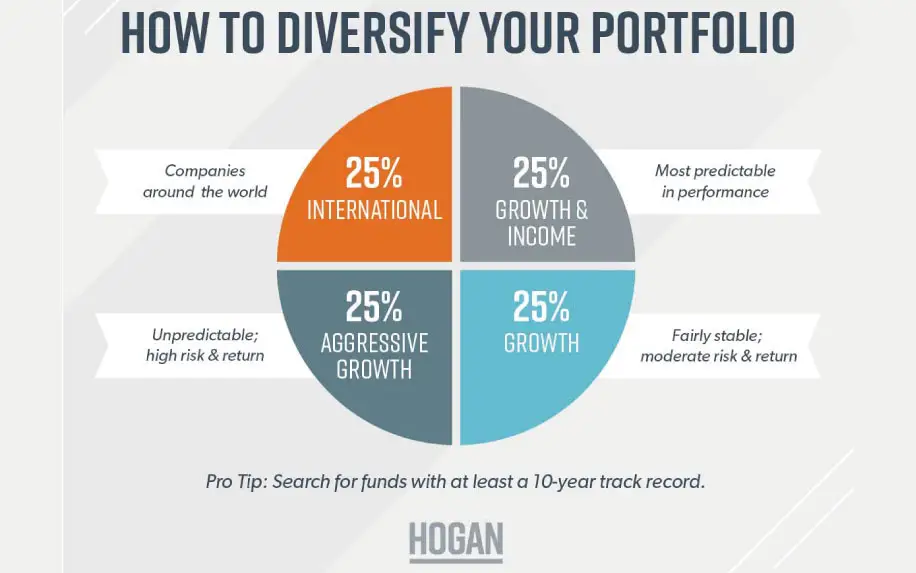

Why Diversification is Essential

Diversification means spreading your money out into different types of investments. Just like having different flavors of ice cream to enjoy, diversifying your investments helps protect your money. If one investment doesn’t do well, the others can still grow, and you won’t lose all your money at once.

Don’t Put Your Eggs in One Basket

Let’s say you really like chocolate ice cream, but what if one day the chocolate flavor runs out? If that’s the only flavor you have, you’ll be disappointed. Investing is similar—having different kinds of investments, like stocks, bonds, and real estate, can help you be prepared for any changes in the market.

The Role of Patience in Investing

Just like planting a seed and waiting for it to grow into a big tree, investing money takes time but can be really rewarding if you’re patient. When you put your money in different places and let it sit and grow, it’s kind of like watching your favorite TV series. You have to wait for the story to unfold, but in the end, it’s worth it!

Learning from the Pros: Successful Investors

Imagine successful investors as the superheroes of the money world. They have special powers and secret tricks that help them make their money super strong. Learning from them can help us become heroes of our own financial adventures.

| Strategies | Explanation |

|---|---|

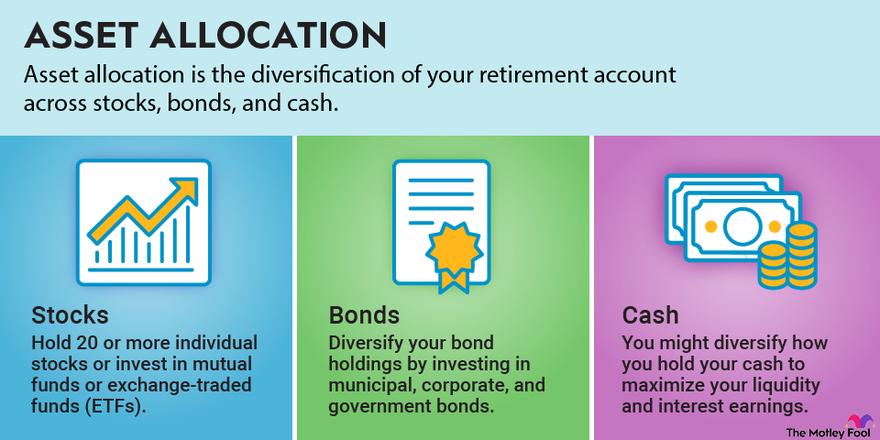

| Diversification | Diversifying your investments across different asset classes can help reduce risk and protect against market volatility. |

| Asset Allocation | Strategically allocating your assets based on your risk tolerance, time horizon, and financial goals can help achieve long-term growth. |

| Regular Rebalancing | Periodically reviewing and adjusting your portfolio to maintain the desired asset allocation can help ensure alignment with your investment objectives. |

| Monitoring Performance | Tracking the performance of your investments and making informed decisions based on market trends and economic conditions can help optimize your portfolio for longevity. |

Image courtesy of www.slidegeeks.com via Google Images

Image courtesy of www.slidegeeks.com via Google Images

Mastering the Art of Research

Successful investors spend time researching and studying to understand where to put their money. It’s like doing homework to find out which video game has the best cheat codes—research is key to making smart investment decisions.

Embracing Risk with Confidence

Just like superheroes face challenges fearlessly, successful investors embrace risks with confidence. They know that with great risk comes the potential for great rewards. It’s like taking a leap of faith, but with a safety net in place.

Staying Calm During Market Storms

When the stock market gets stormy and chaotic, successful investors stay calm like superheroes in a tough situation. They don’t let panic dictate their decisions. Instead, they think rationally and stick to their long-term plans.

Adapting and Evolving Strategies

Superheroes always have to adapt to new villains and challenges, and successful investors do the same. They continuously evolve their strategies based on changing market conditions, staying one step ahead of the game.

Starting Young: The Power of Time

When you’re young, you have something super powerful—time! The more time your money has to grow, the bigger it can become.

Think of it like planting a magical money seed. The earlier you plant it, the longer it has to soak up sunlight and water, and the taller and stronger it can grow. It’s like having a money tree that keeps growing taller and taller the longer you let it grow.

So, when you start investing at a young age, you’re giving your money the biggest gift of all—time. Even if you can only save a little bit each week or month, that money has years and years to grow and become something great.

Just imagine, by the time you’re all grown up, that small bit of money you saved when you were a kid could have turned into something really special. It’s like giving your future self a big high-five for thinking ahead!

Putting It All Together: Building Your Long-Term Portfolio

Now that we’ve learned so much about investing for longevity, it’s time to put all the pieces together and build your very own long-term investment portfolio. Think of it as creating your own Lego castle, but instead of colorful bricks, you’ll be assembling a fortress of money-making opportunities!

Image courtesy of www.fool.com via Google Images

Image courtesy of www.fool.com via Google Images

Long-term Investment Portfolio Optimizer

When you’re building your portfolio, you want to optimize it for the long run. This means choosing investments that have the potential to grow steadily over many years. Just like selecting the best Lego pieces to build a sturdy castle, you’ll need to pick solid investments that can weather the ups and downs of the market.

Remember, diversification is key—just like having a variety of Lego pieces to build different parts of your castle, spreading your money across different types of investments can help protect your portfolio from risks.

By using what we’ve learned about market trends, stock forecasting, analytics platforms, risk management software, and risk assessment calculators, you can make informed decisions about where to put your money for the best long-term growth.

And don’t forget about the power of time! Just like patiently building your Lego castle one brick at a time, investing for the long term requires time and dedication to see your money grow into something impressive.

So, gather your tools, plan your strategy, and start building your long-term investment portfolio today. With the right approach and a bit of patience, you’ll be well on your way to financial success!

Conclusion: Your Future as a Smart Investor

We’ve talked a lot about making your money grow up big and strong. Remember, it’s like a great adventure where being smart and patient pays off big time!

Frequently Asked Questions (FAQs)

Got more questions? No worries! Let’s dive into some common things kids wonder about making money grow for a long, long time.

What does ‘investing for longevity’ mean?

Investing for longevity means planning to make your money grow over a really long time—like waiting for a tiny seed to grow into a huge tree!

Why should I start investing when I’m young?

Starting young gives your money lots of time to grow, making it easier for you to reach your money goals as you get older.

Is investing the same as saving money?

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

Investing is like sending your money on a mission to grow, while saving is more like keeping your money safe under your bed.

Image courtesy of Quang Nguyen Vinh via

Image courtesy of Quang Nguyen Vinh via