Find out how to strategically plan and optimize your investments for maximum growth potential over the long term. Don’t miss out!

Table of Contents

- Introduction to Investing Smart

- The Journey of Long-Term Investment

- Choosing Your Investment Tools

- Understanding Risk with Advanced Software

- Diving Into Market Trends

- Making Smart Choices in the Stock Market

- The Art of Patience in Investments

- Learning and Growing as an Investor

- Protecting Your Future

- Conclusion: Your Adventure in Investing

- Frequently Asked Questions (FAQs)

Introduction to Investing Smart

Investing is like planting a seed and watching it grow into a strong tree over time. It’s a way for adults to save money for their future needs and dreams. When done wisely, investments can multiply and provide financial security for the long haul.

What is Investing?

Investing is putting your money into different things like stocks or businesses with the hope that they will grow in value. It’s like buying a piece of a company and sharing in its profits. Instead of spending all your money now, you invest it to make more money later.

The Journey of Long-Term Investment

Investing in something for the long term means you’re looking at the big picture. It’s like planting a seed and watching it grow into a tall, strong tree. Let’s dive into the world of long-term investments and discover why patience is the key to success.

Optimize Investments for the Long Haul

What Makes an Investment Long-Term?

When we talk about a long-term investment, we mean putting your money into something with the intention of letting it grow over many years. This could be stocks, bonds, or even real estate. The important thing is that you’re willing to wait and not rush to take your money out at the first sign of trouble. Long-term investments are like building a sturdy house – you need a solid foundation and time to see it grow.

Choosing Your Investment Tools

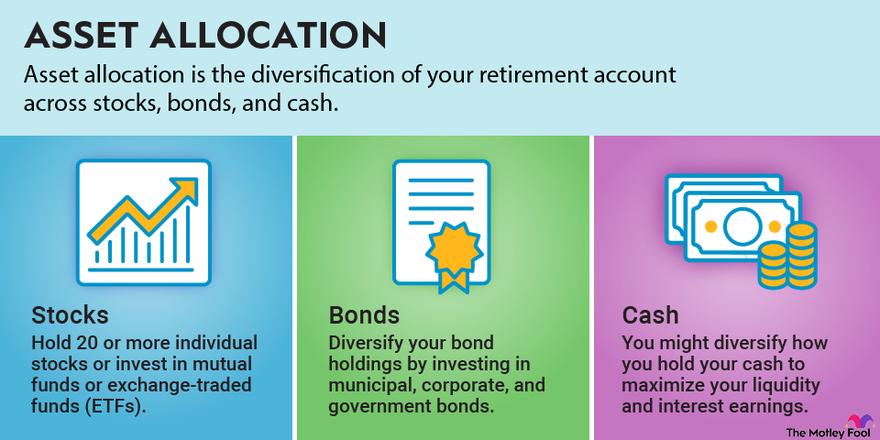

When it comes to investing for the long haul, selecting the right tools can make a significant difference in growing your money steadily over time. Let’s explore some key investment tools that can help you make smart decisions and optimize your long-term investment portfolio.

Image courtesy of www.fool.com via Google Images

Using a Portfolio Optimizer

A long-term investment portfolio optimizer is like having a personal assistant for your investments. It helps you analyze your current investments, assess their performance, and make informed decisions about where to allocate your money for maximum growth. By using a portfolio optimizer, you can ensure that your investments are diversified, helping spread out risk and potentially increasing your returns over time.

The Right Tools for Beginners

For beginners just starting in the world of investing, it’s essential to choose user-friendly platforms that provide clear insights and guidance. The best trading analytics platform for beginners will offer educational resources, easy-to-understand charts and graphs, and straightforward explanations of key investment concepts. These tools can help you navigate the complexities of the market and make confident decisions about where to put your money.

Understanding Risk with Advanced Software

Investing in the stock market can be both exciting and nerve-wracking. One key aspect of successful investing is understanding and managing risk. Risk refers to the possibility of losing money on an investment. This is where advanced risk management software for investors plays a critical role.

Why Managing Risk is Important

Managing risk is crucial because it helps protect your hard-earned money. advanced risk management software for investors uses complex algorithms to analyze various factors such as market volatility, economic indicators, and historical data to provide a comprehensive risk assessment. By using this software, investors can make more informed decisions and reduce the chances of significant financial losses.

Diving Into Market Trends

market trends are like the waves at the beach. They go up and down, showing whether certain things, like stocks, are getting more popular or not. Imagine everyone suddenly wants a new toy, the price of that toy would go up because it’s in demand. Market trends help us understand what people want to buy or sell.

Image courtesy of www2.deloitte.com via Google Images

Image courtesy of www2.deloitte.com via Google Images

Predicting the Future of Stocks

Have you ever tried to guess what your favorite team would do in a game? Forecasting software tries to do the same but for stocks. It looks at how prices have changed in the past and tries to predict how they might change in the future. It’s like having a fortune teller for the stock market!

Making Smart Choices in the Stock Market

When it comes to investing in the stock market, making smart choices can make all the difference in the growth of your money. By utilizing tools like stock market trend forecasting software and risk assessment calculators, you can increase your chances of success.

What to Buy and When?

One of the key aspects of investing in the stock market is knowing what to buy and when to buy it. This is where stock market trend forecasting software can be incredibly helpful. This type of software analyzes past market data to identify patterns and trends that can help you predict the future movement of stocks.

By using this software, you can make more informed decisions about which stocks to invest in, based on data and analysis rather than gut feelings or speculation. This can help you optimize your investment portfolio for the long haul, increasing your chances of success.

Additionally, risk assessment calculators for stock traders can help you understand the level of risk associated with each investment. By assessing the risk involved, you can make more calculated decisions about where to allocate your money.

Overall, by utilizing forecasting software and risk assessment tools, you can make smarter choices in the stock market, ultimately leading to a more successful investment journey.

The Art of Patience in Investments

When it comes to investing, patience is truly a virtue. It may be tempting to try to make quick profits by jumping in and out of investments frequently, but this often leads to more harm than good. Quick decisions based on short-term market movements can cause unnecessary stress and potentially result in losses.

Image courtesy of tai-software.com via Google Images

Image courtesy of tai-software.com via Google Images

Instead of trying to time the market perfectly or chase after the latest investment trend, successful investors understand the value of long-term thinking. By staying patient and allowing investments the time they need to grow, you’re more likely to see steady and sustainable returns over the years.

Remember, the key to successful investing is not about making rapid changes but about making informed and strategic decisions that align with your long-term financial goals. Patience pays off in the world of investments, so take your time, do your research, and trust in the process.

Learning and Growing as an Investor

Investing is a journey that never stops. Just like learning new things in school, becoming a successful investor requires ongoing education and growth. Let’s explore how you can keep getting better at managing your money and making smart investment choices.

The Rollercoaster of Investing in Stocks

Imagine investing in stocks in 1985, experiencing the ups and downs of the market, from Black Monday to the Great Recession, and ultimately witnessing a market rebound and setting new records. This transcript describes the journey of someone who started investing at 18 and the power of long-term investing.

How to Start Investing in Stocks on Your Phone

This section walks you through the process of setting up an account, depositing funds, and selecting investments using the Trading 212 app. It emphasizes the importance of starting with a tax-advantaged account and building an emergency fund before diving into investing.

Automating Investments and Building a Winning Strategy

Learn about automating long-term investments, creating a diversified portfolio using index funds, and setting up regular contributions to maximize returns over time. The importance of staying consistent and patient when it comes to investing in stocks is highlighted in this section.

Picking Individual Stocks and Analyzing Investments

This section delves into the process of picking individual stocks using fundamental analysis and provides tips for beginners on using the Trading 212 app to find and purchase stocks. It also discusses the difference between market orders and limit orders when buying stocks.

Understanding the Risks and Benefits of Investing

Finally, the transcript touches upon the risks and benefits of investing and highlights the importance of starting young, diversifying your portfolio, and staying the course during market fluctuations. Historical data shows that consistent investing can lead to significant growth over time.

Keep Learning About Money and Markets

Imagine being able to understand how money works and how to make it grow by investing wisely. By staying curious and continuously learning about the world of finance, you can become a savvy investor over time.

| Investment Option | Expected Return | Risk Level |

|---|---|---|

| S&P 500 Index Fund | 7% | Low |

| Real Estate Investment Trusts (REITs) | 5% | Medium |

| Government Bonds | 3% | Low |

| High-Yield Corporate Bonds | 6% | High |

Start by reading books, watching videos, and asking questions about investments. Discover how different companies make money and how their stocks can grow or fall in value. Understanding the basics of economics and finance will give you a solid foundation for making informed investment decisions in the future.

Learning about markets and how they behave will also help you predict trends and make smarter choices with your money. Pay attention to the news and how world events can impact the value of stocks and other investments. The more you know, the better equipped you’ll be to navigate the ups and downs of the financial world.

Remember, investing is a skill that gets better with practice. Don’t be afraid to make mistakes along the way – they’re all part of the learning process. By staying curious and eager to learn, you’ll be well on your way to becoming a successful investor in the long run.

Protecting Your Future

Investing your money for the long haul is not just about making smart choices in the stock market; it’s also about protecting your future financial stability. Using advanced risk management software for investors can help you navigate the ups and downs of the market with confidence.

Image courtesy of www.fool.com via Google Images

Image courtesy of www.fool.com via Google Images

The Balance between Risk and Safety

When it comes to investing, there’s always a trade-off between risk and safety. While taking on more risk can potentially lead to higher returns, it also opens you up to the possibility of losing money. This is where advanced risk management software plays a crucial role.

This software helps you analyze and understand the level of risk associated with each investment you make. By using tools like risk assessment calculators, you can make informed decisions about where to put your money and how much risk you’re willing to take on.

Protecting your future means finding the right balance between growing your investments and safeguarding them against potential losses. By incorporating advanced risk management software into your investment strategy, you can feel more secure in your financial future.

Conclusion: Your Adventure in Investing

Investing can seem like a big and complex world, but with the right tools and knowledge, you can navigate it successfully. Remember, investing is not just about making money quickly; it’s about growing your wealth over time and securing your financial future. Here are some key takeaways from your investing adventure:

Your Investment Tools Matter

Using tools like a long-term investment portfolio optimizer and the best trading analytics platform for beginners can make a huge difference in how you manage your investments. These tools help you make smarter decisions and stay on top of market trends.

Risk Management is Key

Understanding and managing risk is crucial in investing. Advanced risk management software for investors and risk assessment calculators can help you protect your money and make informed decisions.

Market Trends and Predictions

Learning about market trends and using stock market trend forecasting software can give you an edge in predicting the future of stocks. This knowledge can guide your investment choices and help you grow your portfolio.

Patience Pays Off

Remember, investing is a long-term game. Hurrying and constantly buying and selling stocks can lead to losses. Patience is key to allowing your investments to grow steadily over time.

Continuously Learn and Grow

Investing is a journey of continuous learning. Keep exploring and expanding your knowledge about money and markets. Stay curious and open to new opportunities for growth.

By combining the right tools, managing risk effectively, understanding market trends, practicing patience, and staying committed to learning, you can set yourself up for a successful adventure in investing. Enjoy the journey and watch your investments grow!

Frequently Asked Questions (FAQs)

What is a long-term investment?

A long-term investment is when you put your money into something with the goal of letting it grow over a long period of time, usually five years or more. Instead of trying to make quick profits, you’re patient and wait for your investment to increase slowly and steadily.

Can kids learn about investing?

Absolutely! Learning about investing can actually be a fun and exciting way to understand how money works and how it can grow over time. By starting to learn about investing early, you can set yourself up for a financially secure future.

How does risk management software work?

Risk management software helps investors like you understand how much risk is involved in different investment choices. It uses advanced calculations to analyze data and predict potential losses. By using this software, you can make smarter decisions about where to put your money.

What are market trends?

Market trends are patterns or tendencies that can be seen in how the stock market moves over time. By looking at market trends, investors can try to predict what might happen next in the stock market. Understanding market trends can help you make better decisions when it comes to investing.

Do I need a lot of money to start investing?

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

Not necessarily! While having more money to invest can lead to bigger returns, you can start investing with as little as a few dollars. There are even platforms and tools designed for beginners that allow you to start small and grow your investment over time.

Image courtesy of FWStudio via

Image courtesy of FWStudio via