Uncover the secrets to maximizing your Forex trading success with these top pro tips that will revolutionize your trading game.

Table of Contents

Introduction to Forex Trading

Forex trading insights and tips play a crucial role in helping traders navigate the complex world of foreign exchange. By understanding the best practices and utilizing the right tools, individuals can enhance their trading strategies and potentially increase their profits. In this section, we’ll delve into what Forex trading is and why knowing the best tips can give you an edge in the market.

What is Forex Trading?

Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies from around the world. It is the largest financial market globally, with trillions of dollars traded daily. The goal of Forex trading is to profit from the fluctuations in exchange rates between different currencies. For example, if you believe the value of the Euro will increase compared to the US Dollar, you can buy Euros in the hope of selling them later at a higher price.

Why Tips are Important

Having access to valuable Forex trading insights and tips can significantly impact your success in the market. These tips can help you understand market trends, make informed decisions, and develop effective trading strategies. Whether you’re a beginner or an experienced trader, learning from experts and incorporating their tips into your trading approach can give you a competitive advantage.

Choosing the Right Tools

When it comes to Forex trading, selecting the right tools is crucial for success. The tools you use can make a significant difference in your trading decisions and outcomes. Let’s delve into why choosing the best trading analytics platform for beginners and a real-time Market analysis tool for day traders is essential.

Optimize Forex: Top ProTrading Tips

Why Analytics Matter

Analytics play a vital role in Forex trading. By analyzing market data and trends, you can make informed decisions about when to buy or sell currencies. Good analytics can provide valuable insights that help you navigate the complexities of the Forex market with more confidence.

Tools for Beginners

For beginners in Forex trading, it’s important to have access to platforms that offer comprehensive educational resources and user-friendly interfaces. The best trading analytics platform for beginners can simplify complex data and present it in a way that is easy to understand. These tools can help you grasp the basics of Forex trading and build a solid foundation for your trading journey.

Tools for Day Traders

Day traders require tools that provide Real-time market analysis to make quick decisions throughout the trading day. A real-time market analysis tool can offer up-to-the-minute data on currency pairs, market trends, and economic events that impact the Forex market. By having access to these tools, day traders can react swiftly to market changes and seize profitable opportunities.

Using ProTradingAssistant

ProTradingAssistant is a powerful tool that can help traders develop personalized trading strategies to optimize their Forex trading experience. Let’s delve into how this innovative platform can assist you in creating strategies tailored to your trading goals.

Image courtesy of www.fiverr.com via Google Images

What is ProTradingAssistant?

ProTradingAssistant is a cutting-edge platform designed to provide traders with real-time market analysis and personalized trading strategies. It offers valuable insights and data to help traders make informed decisions and stay ahead in the fast-paced world of Forex trading.

Generating Personalized Strategies

With ProTradingAssistant, you can generate personalized trading strategies based on your unique preferences and risk tolerance. By inputting your trading goals and parameters into the platform, ProTradingAssistant uses advanced algorithms to create strategies that align with your specific needs.

Whether you’re a beginner looking to start trading or an experienced trader seeking to refine your approach, ProTradingAssistant can help you develop strategies that suit your individual trading style and objectives.

Understanding Market Signals

Trading signals are indicators or suggestions that help traders identify potential opportunities in the market. These signals can be generated by analyzing various factors like price movements, volume, and technical indicators. By following these signals, traders can make informed decisions on when to buy or sell assets.

Finding a Signals Provider

When looking for a signals provider, it’s essential to choose one that offers accurate and profitable signals. A good signals provider will have a track record of success and provide timely information to help traders capitalize on market opportunities. It’s crucial to do thorough research and consider factors like reliability, reputation, and transparency before selecting a signals provider.

The Importance of Technical Analysis

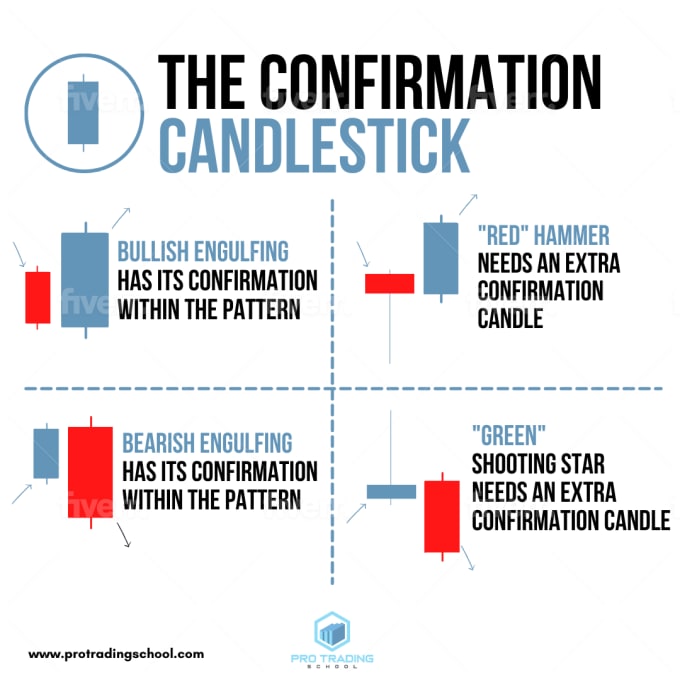

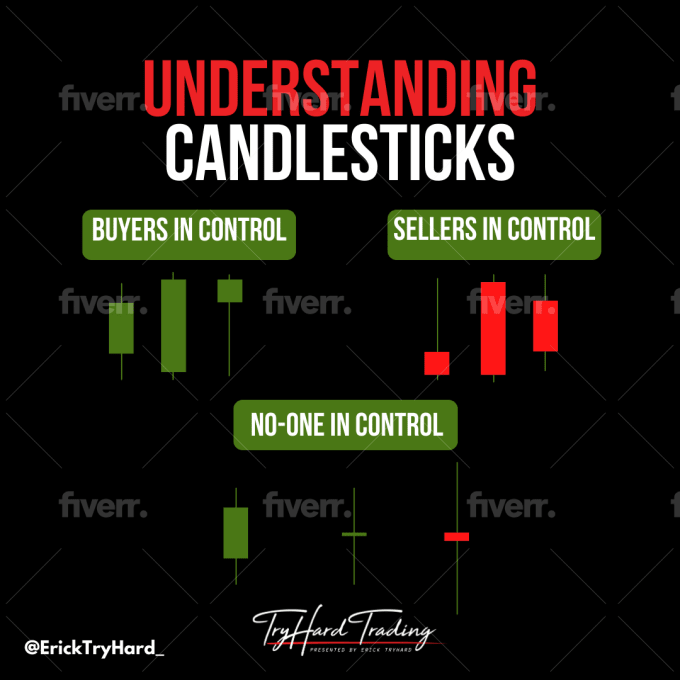

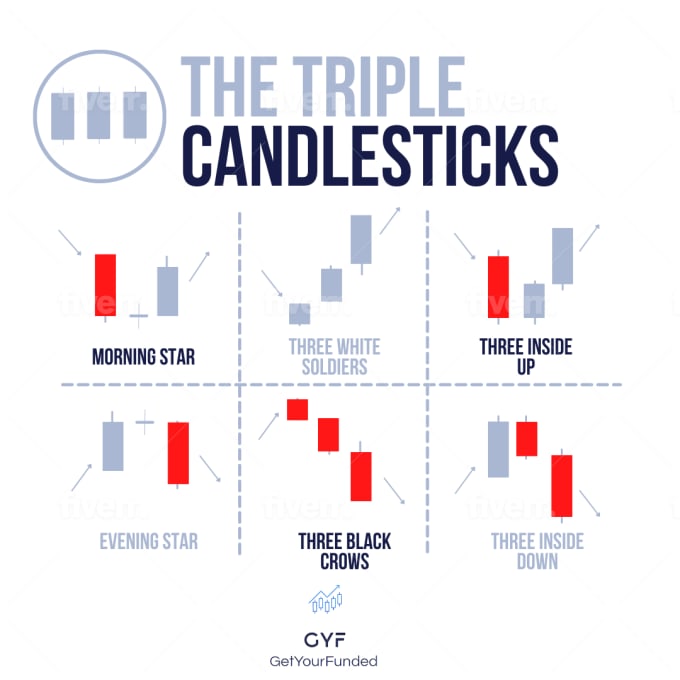

When it comes to trading in the Forex market, one of the essential tools that traders use is technical analysis charts. These charts play a crucial role in helping traders predict future market movements and make informed trading decisions.

Image courtesy of www.fiverr.com via Google Images

Image courtesy of www.fiverr.com via Google Images

Reading Charts

Technical analysis charts are visual representations of a currency pair’s price movements over time. By studying these charts, traders can identify patterns and trends that may indicate the direction in which prices are likely to move in the future.

For example, if a chart shows a pattern of higher highs and higher lows, it could suggest an uptrend in the market. Conversely, a pattern of lower highs and lower lows may indicate a downtrend.

Charts also display various technical indicators, such as moving averages and RSI (Relative Strength Index), which can help traders gauge market sentiment and potential price reversals.

Making Predictions

By analyzing technical analysis charts, traders can make predictions about future price movements and adjust their trading strategies accordingly. For instance, if a chart pattern indicates a potential breakout, a trader might decide to enter a trade to capitalize on the expected price movement.

Additionally, technical analysis can help traders set profit targets and stop-loss levels based on historical price data and market trends. This information allows traders to manage risk effectively and optimize their trading outcomes.

In conclusion, mastering technical analysis is essential for Forex traders looking to enhance their trading skills and maximize their profitability in the market.

Trading in Cryptocurrency

Forex trading involves exchanging different currencies, such as trading US dollars for euros. On the other hand, cryptocurrency trading involves buying and selling digital currencies like Bitcoin or Ethereum. While both types of trading can be profitable, cryptocurrency trading is known for its higher volatility and potential for quick gains or losses.

| Tip Number | ProTrading Tip |

|---|---|

| 1 | Implement a solid trading plan with clearly defined goals |

| 2 | Start with a demo account to practice without risking real money |

| 3 | Use stop-loss orders to manage risk and protect your investments |

| 4 | Stay informed about market news and events that can affect currency prices |

| 5 | Diversify your trading portfolio to spread out risk |

| 6 | Keep emotions in check and stick to your trading strategy |

| 7 | Regularly review and analyze your trading performance to identify strengths and weaknesses |

| 8 | Consider using technical analysis tools to make informed trading decisions |

Specific Tips for Cryptocurrency Traders

For those interested in trading cryptocurrencies, here are some specific tips to keep in mind:

1. Stay Informed: Cryptocurrency markets can be influenced by news and events. Stay updated on the latest developments in the crypto world to make informed trading decisions.

2. Use Stop-Loss Orders: To manage risk, consider using stop-loss orders to automatically sell your cryptocurrency if its price reaches a certain point. This can help limit potential losses.

3. Diversify Your Portfolio: Instead of putting all your money into a single cryptocurrency, consider diversifying your portfolio by investing in multiple digital assets. This can help spread risk.

4. Choose a Secure Exchange: When trading cryptocurrencies, it’s important to use a reputable and secure exchange. Research different platforms and choose one with a good reputation for safety and reliability.

Developing a Trading Plan

When it comes to Forex trading, having a solid trading plan is crucial for success. Let’s delve into the steps involved in creating a robust trading plan using personalized strategies generated with the help of tools and insights.

Image courtesy of www.fiverr.com via Google Images

Image courtesy of www.fiverr.com via Google Images

Setting Goals

One of the first steps in developing a trading plan is setting clear and realistic goals. Ask yourself what you aim to achieve through Forex trading. Whether it’s financial independence, building wealth, or simply honing your trading skills, having specific goals will guide your trading decisions and keep you focused.

Risk Management

Managing risks effectively is another key aspect of a trading plan. While trading can be profitable, it also carries inherent risks. By defining your risk tolerance and implementing Risk management strategies, you can protect your capital and avoid significant losses. Diversifying your portfolio, setting stop-loss orders, and avoiding emotional trading are all essential components of risk management.

Staying Updated with Markets

As a Forex trader, staying updated with the latest market news is crucial for making informed trading decisions. Market news can affect currency values, so being aware of global events, economic data releases, and political developments is essential. By keeping up with market news, you can anticipate potential market movements and adjust your trading strategies accordingly.

Using Analysis Tools

Utilizing real-time market analysis tools can help you stay updated and react quickly to market changes. These tools provide valuable insights, such as price movements, trends, and volatility, allowing you to make timely decisions. By incorporating analysis tools into your trading routine, you can enhance your trading efficiency and increase your chances of success in the Forex market.

Practicing with Simulations

Trading in the Forex market can be challenging, especially for beginners. That’s where simulations come in. Simulations provide a risk-free environment for you to practice trading without using real money. Let’s explore how simulations work and why they are a valuable tool for those starting out in Forex trading.

Image courtesy of www.fiverr.com via Google Images

Image courtesy of www.fiverr.com via Google Images

What Are Simulations?

Simulations are virtual trading platforms that mimic real market conditions. They allow you to place trades, monitor market movements, and experience the highs and lows of trading without any financial risk. Essentially, simulations provide a safe space for you to learn and improve your trading skills.

Benefits of Practicing

There are several benefits to practicing trades using simulations. Firstly, it allows you to gain hands-on experience without risking your hard-earned money. This can help build your confidence and improve your decision-making skills as a trader. Additionally, simulations can help you test different trading strategies and understand how various market factors can impact your trades.

Tips Recap

Throughout this article, we’ve covered a lot of valuable information to help you optimize your Forex trading experience. Let’s quickly recap the key tips to keep in mind:

Tips for Successful Forex Trading

1. Understand the basics of Forex trading and how it involves exchanging currencies.

2. Select the right tools, such as the best trading analytics platform for beginners and real-time market analysis tools for day traders.

3. Utilize ProTradingAssistant to generate personalized trading strategies that suit your goals.

4. Pay attention to trading signals and find a provider that offers profitable signals.

5. Learn how to read and interpret technical analysis charts to predict market movements.

6. Apply Forex trading tips to the cryptocurrency market by understanding the similarities and differences.

7. Develop a solid trading plan with personalized strategies and effective risk management techniques.

8. Stay updated with market news and use real-time analysis tools to make informed decisions.

9. Practice trading with simulations on platforms to gain experience without risking actual funds.

By following these tips, you’ll be on your way to becoming a successful Forex trader. Remember, knowledge and practice are key to your growth in the market.

FAQs

What is Forex Trading?

Forex trading is simply the exchange of one currency for another. Just like how you trade your toys with a friend, in Forex trading, people trade different currencies to make money.

How Can I Use ProTradingAssistant?

To start using ProTradingAssistant, all you need to do is sign up on their platform. Once you’re in, you can explore the different features it offers, like generating personalized trading strategies to enhance your trading journey.

What Are Trading Signals?

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

Trading signals are like secret messages that help traders know when to buy or sell a specific currency. They give hints about the best times to make a trade, making it easier for traders to make profits.

Image courtesy of Stanislav Kondratiev via

Image courtesy of Stanislav Kondratiev via