Unlock the secrets to maximizing gains and increasing profits with these powerful and profitable signals. Are you ready to start?

Table of Contents

- Introduction: Finding Your Treasure Map in Trading

- What Are Trading Signals?

- First Steps in Trading: The Beginner’s Journey

- Real-Time Market Analysis: Why Timing is Everything

- Swing Trading: Making Money in the Waves

- Options Trading: Choosing Your Own Adventure

- Technical Analysis: The Secret Code of Price Charts

- Becoming a Treasure Hunter: Building Your Skills

- Safety First! Avoiding Traps and Scams

- Ask an Expert: Tips from Pros

- Practice Makes Perfect: Simulating Trades

- Taking the Leap: Starting Your First Trade

- Summary: The Adventurer’s Map to Trading

- FAQs: Answering Your Curious Questions

Introduction: Finding Your Treasure Map in Trading

Think of profitable trading signals like a treasure map. They are special hints that help people who trade find the best spots to make money. Just like pirates hunting for gold!

What Are Trading Signals?

We’ll explore what trading signals are and how they work, kind of like clues in a game that guide you to make good choices. Think of profitable trading signals like a treasure map. They are special hints that help people who trade find the best spots to make money. Just like pirates hunting for gold!

First Steps in Trading: The Beginner’s Journey

If you’re new to trading, you’ll need simple tools to start your adventure. Imagine starting a new video game – you need the best equipment and guidance to succeed. In trading, having the best trading analytics platform for beginners is like having a powerful weapon in your hands. It helps you see the game (the market) clearly and make smart decisions.

Image courtesy of biz.source.colostate.edu via Google Images

Real-Time Market Analysis: Why Timing is Everything

When it comes to trading, timing plays a crucial role in determining success. Just like looking at the weather forecast before planning a fun day out, it’s essential for traders to keep an eye on real-time market analysis to make informed decisions. This analysis provides valuable insights into the current market conditions, helping traders navigate the unpredictable waters of the financial world.

Maximize Gains with Profitable Signals

The Importance of Real-Time Market Analysis for Day Traders

For day traders, who make quick decisions based on short-term price movements, real-time market analysis is like having a compass that points them in the right direction. It allows them to spot opportunities and react swiftly to changes in the market. By staying up-to-date with the latest data and trends, day traders can capitalize on profitable trading signals and maximize their gains.

Utilizing Real-Time Market Analysis Tools

Thanks to advancements in technology, traders now have access to powerful tools that provide real-time market analysis. These tools use algorithms and data analytics to track market movements, identify patterns, and generate trading signals. By leveraging these tools, day traders can make well-informed decisions based on accurate and timely information.

Maximizing Profit Potential with Real-Time Insights

By incorporating real-time market analysis into their trading strategies, day traders can increase their chances of success. Whether it’s detecting price fluctuations, anticipating market trends, or identifying trading opportunities, staying on top of real-time data is key to maximizing profit potential. With the right tools and information at their disposal, traders can navigate the markets with confidence and precision.

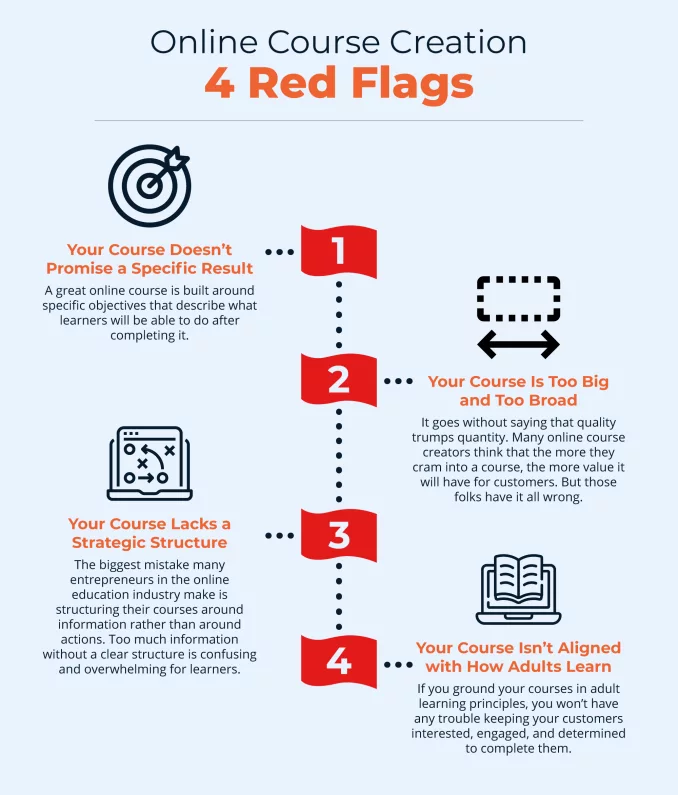

Swing Trading: Making Money in the Waves

Swing trading is like trying to ride the waves in the ocean. Just as surfers wait for the perfect wave to catch, swing traders wait for the right moment to make a trade and ride the price movements for profit. It’s all about timing and strategy.

Image courtesy of clientengagementacademy.com via Google Images

Image courtesy of clientengagementacademy.com via Google Images

Swing trading strategies with ProTradingAssistant

ProTradingAssistant is a handy tool that helps swing traders analyze the market and identify potential entry and exit points for their trades. It works like a GPS for traders, guiding them towards profitable opportunities and helping them navigate the ups and downs of the market.

With ProTradingAssistant, traders can develop and test different strategies to find the most effective one for their trading style. The tool provides real-time market insights and technical analysis, giving traders the information they need to make informed decisions and maximize their profits.

By using swing trading strategies with ProTradingAssistant, traders can take advantage of short- to medium-term price movements in the market. This approach allows them to capture profits from both up and down swings, making money in the waves of market volatility.

Options Trading: Choosing Your Own Adventure

Options trading is like choosing your own adventure in a game. Instead of following a set path, you get to make decisions along the way to reach the best outcome possible. Let’s explore some ways to make the best choices in options trading.

Options Trading Strategies Optimizer

When you trade options, you have the freedom to pick different strategies depending on what you think will happen in the market. It’s like having a toolbox with various tools, and you need to choose the right one for the job. An options trading strategies optimizer helps you analyze the best strategies for your trades, making the decision-making process easier.

For example, if you believe a stock will go up in price, you might use a bullish options strategy like buying a call option. On the other hand, if you think a stock will drop, you might consider a bearish strategy like buying a put option. By optimizing your strategies, you increase your chances of success in options trading.

Remember, choosing the right strategy is crucial in options trading. Just like picking the right path in a game, your decisions can lead to different outcomes.

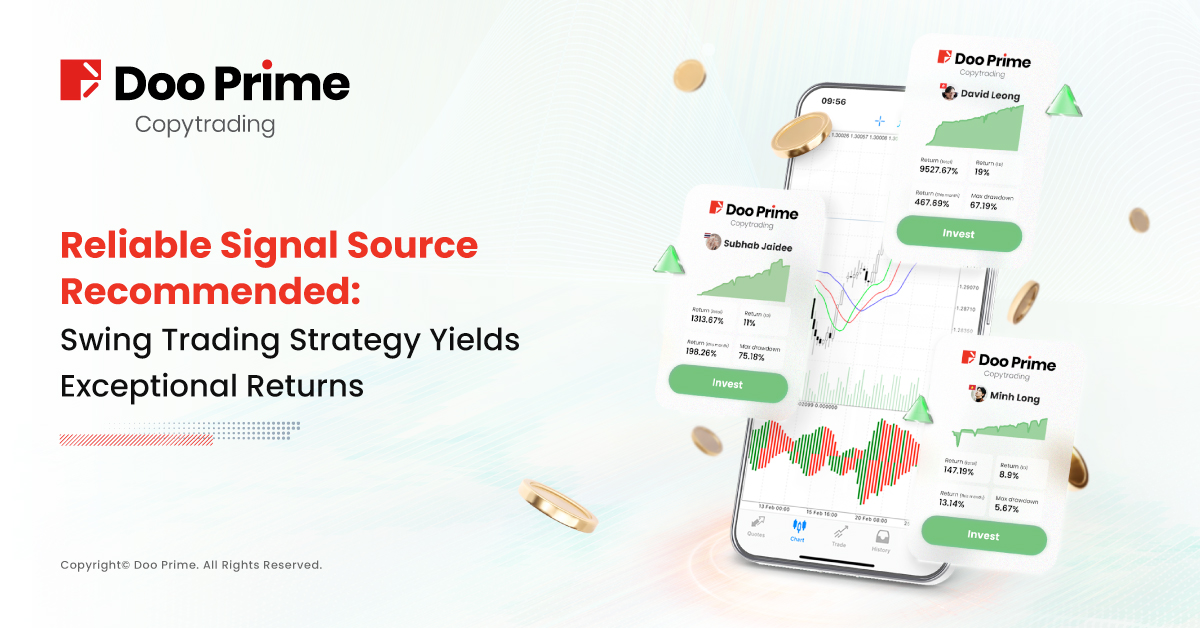

Technical Analysis: The Secret Code of Price Charts

Reading price charts is like finding secret codes that can help you make smart decisions when trading cryptocurrencies. Just like how detectives look for clues to solve a mystery, traders use technical analysis charts to uncover patterns in the price movements of digital coins.

Image courtesy of www.dooprimenews.com via Google Images

Image courtesy of www.dooprimenews.com via Google Images

Unlocking the Secrets

When you look at a price chart, you’ll see lines and graphs that show how the value of a cryptocurrency has changed over time. By studying these patterns, traders can predict when the price might go up or down, helping them make better choices about when to buy or sell.

Identifying Trends

One important part of technical analysis is identifying trends in the price movements. Just like how a wave at the beach goes up and down, prices in the cryptocurrency market also move in patterns. By recognizing these trends, traders can ride the wave to make profitable trades.

Support and Resistance Levels

Another key concept in technical analysis is understanding support and resistance levels on a price chart. Support is like a floor that prevents the price from falling further, while resistance acts like a ceiling that stops the price from rising. Traders use these levels to determine when to enter or exit a trade.

Using Indicators

Traders also use indicators, such as moving averages and relative strength index (RSI), to help them analyze price charts. These indicators provide additional information about the strength of a trend or when a cryptocurrency might be overbought or oversold, guiding traders in their decision-making process.

With technical analysis charts as their secret weapon, cryptocurrency traders can decode the hidden messages within price movements and increase their chances of making profitable trades.

Becoming a Treasure Hunter: Building Your Skills

All great explorers practice their skills. You can become a treasure hunter in trading by learning and practicing these strategies.

Practice Makes Perfect

Before you start for real, practice trading in a simulation to get better, like playing a practice round of a video game. It’s essential to hone your skills and get comfortable with the tools and techniques of trading.

Educate Yourself

Read books, take online courses, and attend seminars on trading. The more you know, the better equipped you’ll be to navigate the complex world of trading. Understanding the fundamentals is key to becoming a successful treasure hunter.

Stay Updated

Keep an eye on the latest market trends and news. Just like sailors need to know the weather forecast before setting sail, traders need to be aware of what’s happening in the financial world. Stay informed to make informed decisions.

Develop a Trading Plan

Create a strategy that aligns with your trading goals. Define your risk tolerance, set profit targets, and establish rules for entering and exiting trades. Having a well-thought-out plan will guide your actions and help you stay focused.

By building your skills through practice, education, staying updated, and developing a solid trading plan, you’ll be on your way to becoming a successful treasure hunter in the world of trading!

Safety First! Avoiding Traps and Scams

Just like in any adventure, there are traps. Learn to stay safe and avoid scams while looking for trading treasures.

Avoiding Fraudulent Signals

When searching for profitable trading signals, be cautious of providers promising unrealistically high returns or guaranteed profits. These are often scams designed to lure in unsuspecting traders. Always research the reputation and track record of a signal provider before trusting their guidance.

Protecting Your Personal Information

Never share sensitive personal information such as your financial details or login credentials with anyone claiming to offer trading signals. Legitimate providers will not ask for this information, and sharing it could leave you vulnerable to identity theft and financial fraud.

Spotting Unrealistic Promises

Be wary of trading platforms or services that make bold claims about overnight success or minimal risk. Trading carries inherent risks, and no system can guarantee constant profits without losses. If something sounds too good to be true, it likely is.

| Signal Type | Accuracy | Profit Potential |

|---|---|---|

| Technical Analysis Signals | 85% | High |

| Fundamental Analysis Signals | 75% | Medium |

| Sentiment Analysis Signals | 90% | High |

| Combined Signals (Technical + Fundamental + Sentiment) | 95% | Very High |

Verifying Credentials

Before subscribing to any trading signal provider or platform, verify their credentials and legitimacy. Look for reviews from other traders, check for any regulatory certifications, and ensure that the company has a transparent track record of success.

By staying vigilant and doing your due diligence, you can navigate the trading landscape safely and avoid falling victim to scams or fraudulent schemes.

Ask an Expert: Tips from Pros

When you’re on a treasure hunt, it’s always a good idea to learn from the best. In the trading world, experts are like wise old pirates who have sailed through many storms. They have valuable tips to share with you, so don’t be afraid to ask them for guidance.

Learn from Experience

One of the best ways to become a successful trader is to learn from the experiences of others. Listen to the stories and advice of seasoned professionals who have been in the trading game for years. Their insights can help you navigate the choppy waters of the market more effectively.

Stay Informed

Successful traders stay informed about the latest trends and market developments. Keep yourself updated by reading trading blogs, watching financial news, and following experts on social media. The more you know, the better equipped you’ll be to make smart decisions in your trading journey.

Practice Makes Perfect: Simulating Trades

Before you start for real, practice trading in a simulation to get better, like playing a practice round of a video game.

Image courtesy of www.merrilledge.com via Google Images

Image courtesy of www.merrilledge.com via Google Images

Exploring Virtual Trading

Virtual trading is like a pretend version of real trading. It’s a safe way to test your skills without using real money. Just like how you might practice your soccer kicks in the backyard before a big game, virtual trading lets you practice trading strategies without any risk.

How Simulations Help

Simulations help you learn how to make smart decisions in trading. You can try out different strategies, see what works best for you, and understand how the market moves. It’s like having a practice round in a video game to master your moves before the real adventure begins.

The Benefits of Practice

Just like practicing the piano can make you a better musician, simulating trades can improve your trading skills. It gives you the chance to make mistakes and learn from them without losing any real money. The more you practice, the more confident and skilled you’ll become in trading.

Taking the Leap: Starting Your First Trade

Are you ready to start your trading adventure? It’s time to take the leap and begin your first real trade. Just like setting sail on a treasure hunt, starting your trading journey can be exciting and rewarding. Let’s dive into the basics of how to make your first trade and begin your quest for trading treasures!

Choosing Your First Trade

Before you dive in, think about what type of trade you want to make. Do you want to buy stocks, trade cryptocurrencies, or explore options trading? Each type of trade has its own unique strategies and risks. Take some time to research and understand the market you’re interested in before making your decision.

Setting Up Your Trading Account

Once you’ve decided on the type of trade you want to make, it’s time to set up your trading account. Choose a reliable trading platform that suits your needs and offers the tools and resources you need to succeed. Make sure to fund your account with the amount you’re comfortable trading with.

Placing Your First Trade

Now comes the exciting part – placing your first trade! Use the trading signals provided by your chosen platform to guide your decision-making process. These signals act as your treasure map, helping you navigate the market and make informed choices. Keep an eye on real-time market analysis tools to help you time your trades effectively.

Monitoring and Learning

After you’ve made your first trade, it’s important to monitor its progress and learn from the experience. Pay attention to how your trade performs and analyze the results. Reflect on what went well and what you could improve on for future trades. Remember, practice makes perfect in trading!

By taking the leap and starting your first trade, you’re embarking on an exciting journey filled with opportunities for growth and success. Stay curious, keep learning, and don’t be afraid to explore new trading strategies and tools along the way. Your trading adventure is just beginning!

Summary: The Adventurer’s Map to Trading

Embarking on the exciting journey of trading is akin to setting sail on a treasure hunt. Just like pirates seeking hidden riches, traders look for valuable opportunities in the market. In this guide, we’ve delved into the key components that make up the adventurer’s map to trading.

What Are Trading Signals?

Trading signals act as your treasure map, guiding you towards profitable opportunities in the market. These signals are like clues in a game, helping you make informed decisions and navigate the waters of trading with confidence.

First Steps in Trading: The Beginner’s Journey

For beginners, finding the best trading analytics platform is crucial. These platforms serve as your starting point, offering user-friendly tools to kickstart your trading adventure. With the right platform, even novice traders can set sail with ease.

Real-Time Market Analysis: Why Timing is Everything

Understanding the importance of real-time market analysis is akin to checking the weather before heading out to sea. Day traders rely on up-to-the-minute data to make quick and informed decisions that can lead to profitable outcomes.

Swing Trading: Making Money in the Waves

swing trading strategies, coupled with tools like ProTradingAssistant, help traders catch the right waves in the market. Just like riding the waves in the ocean, mastering swing trading can lead to significant gains for your trading portfolio.

Options Trading: Choosing Your Own Adventure

Options trading offers traders the flexibility to choose different paths, much like selecting the best strategy in a game. By optimizing your options trading strategies, you can tailor your approach to suit your unique risk tolerance and financial goals.

Technical Analysis: The Secret Code of Price Charts

Unlocking the secrets of technical analysis charts is akin to deciphering hidden codes. Cryptocurrency traders use these charts to gain insights into market trends and make informed decisions based on price movements.

Becoming a Treasure Hunter: Building Your Skills

Like all great explorers, traders must hone their skills to become successful treasure hunters in the market. By learning and practicing different strategies, you can navigate the complexities of trading with confidence and precision.

Safety First! Avoiding Traps and Scams

Just as in any adventure, there are risks and traps to avoid in trading. By staying vigilant and learning how to spot scams, you can protect yourself and your investments while seeking out profitable opportunities.

FAQs: Answering Your Curious Questions

What is a trading signal, really?

Think of a trading signal like a secret whisper telling you when to buy or sell in a game of hot potato. It’s like having a cheat code to help you make better choices in trading.

Can trading be done by kids too?

Trading is mostly for grown-ups, but learning about it can make you super smart! It’s like learning a cool new game that challenges your brain and helps you understand how money works.

Is it easy to start trading?

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

With the right tools and help, it’s like learning to ride a bike with training wheels! Starting trading may seem a bit tricky at first, but once you get the hang of it and practice, it becomes easier and more fun.

Image courtesy of maitree rimthong via

Image courtesy of maitree rimthong via