Uncover the secrets of top traders as we delve into the world of customizing strategies for success in trading.

Table of Contents

- Best Trading Analytics Platform for Beginners

- Real-time Market Analysis Tool for Day Traders

- Advanced Risk Management Software for Investors

- Swing Trading Strategies with ProTradingAssistant

- Long-term Investment Portfolio Optimizer

- Technical Analysis Charts for Cryptocurrency Traders

- Algorithmic Trading Automation Solutions

- Profitable Trading Signals Provider

- Risk Assessment Calculator for Stock Traders

- Personalized Trading Strategies Generator

- In-depth Market Trend Analysis Tool

- Conclusion

Welcome to the world of trading! Whether you are a beginner looking to get started or an experienced investor seeking to enhance your strategies, having the right tools and platforms can make a significant difference in your success. In this blog post, we will explore 10 must-have trading tools and platforms that can help you trade like a pro and achieve your financial goals.

Best Trading Analytics Platform for Beginners

As a beginner trader, it is crucial to have access to a user-friendly trading analytics platform that can provide you with valuable insights and data to make informed decisions. Look for a platform that offers easy navigation, clear visuals, and comprehensive analysis tools tailored for beginners.

Real-time Market Analysis Tool for Day Traders

For day traders, staying updated with real-time market analysis is essential. A reliable market analysis tool can help you track market trends, monitor price movements, and identify potential opportunities for quick trades. Choose a tool that offers real-time data and alerts to stay ahead of the game.

Trading Like a Pro: Customizing Strategies for Success

Advanced Risk Management Software for Investors

Investors understand the importance of managing risks effectively to protect their investments. Advanced risk management software can help you assess and mitigate potential risks, set stop-loss orders, and create a solid risk management strategy. Invest in software that offers comprehensive risk assessment tools to safeguard your capital.

Image courtesy of www.linkedin.com via Google Images

Swing Trading Strategies with ProTradingAssistant

Swing trading can be a profitable trading strategy when executed correctly. With ProTradingAssistant, you can optimize your swing trading strategies by leveraging advanced analytics, trend analysis, and technical indicators. Customize your trading approach to suit your risk tolerance and investment goals for successful swing trades.

Long-term Investment Portfolio Optimizer

Building a long-term investment portfolio requires careful planning and optimization. An investment portfolio optimizer can help you diversify your investments, rebalance your portfolio, and maximize returns over the long term. Utilize this tool to create a well-rounded portfolio that aligns with your financial objectives.

Image courtesy of www.etsy.com · In stock via Google Images

Image courtesy of www.etsy.com · In stock via Google Images

Technical Analysis Charts for Cryptocurrency Traders

Cryptocurrency trading can be highly volatile, making technical analysis charts a valuable resource for traders. These charts offer insights into price trends, market sentiment, and potential entry and exit points for profitable trades. Use technical analysis charts to enhance your cryptocurrency trading strategies and make informed decisions.

Algorithmic Trading Automation Solutions

Automating your trading strategies can streamline your trading process and improve efficiency. Algorithmic trading automation solutions allow you to execute trades, set parameters, and manage risks automatically. Explore these solutions to enhance your trading performance and capitalize on market opportunities.

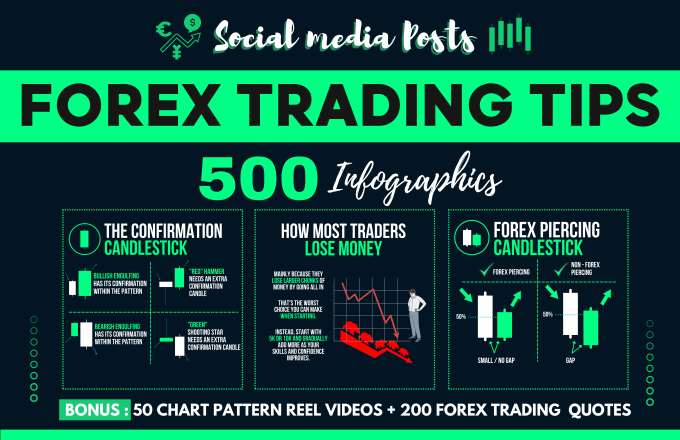

Image courtesy of www.fiverr.com via Google Images

Image courtesy of www.fiverr.com via Google Images

Profitable Trading Signals Provider

Accessing reliable trading signals can give you a competitive edge in the market. A profitable trading signals provider offers timely and accurate signals based on market analysis and trend forecasting. Subscribe to a reputable provider to receive valuable insights and potential trading opportunities.

Risk Assessment Calculator for Stock Traders

Stock traders can benefit from using a risk assessment calculator to evaluate potential risks and rewards before making a trade. This tool helps you determine the optimal position size, manage risk effectively, and protect your capital. Incorporate a risk assessment calculator into your trading routine for smarter decision-making.

Image courtesy of www.upwork.com · In stock via Google Images

Image courtesy of www.upwork.com · In stock via Google Images

Personalized Trading Strategies Generator

Every trader has unique preferences and risk tolerance levels when it comes to trading. A personalized trading strategies generator can create customized trading strategies tailored to your individual needs and goals. Experiment with different strategies, adjust parameters, and optimize your trading approach for greater success.

In-depth Market Trend Analysis Tool

Understanding market trends is essential for making informed trading decisions. An in-depth market trend analysis tool provides you with comprehensive insights into market dynamics, price movements, and emerging trends. Stay ahead of the curve by utilizing this tool to identify market opportunities and adjust your strategies accordingly.

Image courtesy of www.pinterest.com via Google Images

Image courtesy of www.pinterest.com via Google Images

Conclusion

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

In conclusion, trading like a pro requires the right tools and platforms to customize your strategies for success. Whether you are a beginner trader or an experienced investor, incorporating these 10 must-have trading tools into your trading routine can enhance your performance, optimize your strategies, and maximize your profits. Take advantage of these tools to trade with confidence, mitigate risks, and achieve your financial goals in the dynamic world of trading.

What are the key benefits of customizing trading strategies?

Customizing trading strategies allows traders to adapt to changing market conditions, mitigate risks, and maximize profitability by tailoring their approach to their individual preferences and goals.

How can algorithmic trading automation solutions enhance trading performance?

Algorithmic trading automation solutions streamline the trading process, execute trades automatically based on predefined parameters, and help traders capitalize on market opportunities efficiently.

Why is risk assessment important for stock traders?

Risk assessment helps stock traders evaluate potential risks and rewards before making trades, determine optimal position sizes, manage risks effectively, and protect their capital.

How can personalized trading strategies generators benefit traders?

Personalized trading strategies generators create customized strategies tailored to individual preferences and goals, allowing traders to experiment with different approaches and optimize their trading performance for greater success.

Image courtesy of Judit Peter via

Image courtesy of Judit Peter via