Learn how to minimize your trading risks and maximize profit potential with our innovative Stock Trader Risk Assessment Calculator today.

Table of Contents

- Best Trading Analytics Platform for Beginners

- Real-time Market Analysis Tool for Day Traders

- Advanced Risk Management Software for Investors

- Swing Trading Strategies with ProTradingAssistant

- Long-term Investment Portfolio Optimizer

- Technical Analysis Charts for Cryptocurrency Traders

- Algorithmic Trading Automation Solutions

- Profitable Trading Signals Provider

- Risk Assessment Calculator for Stock Traders

- Personalized Trading Strategies Generator

- In-depth Market Trend Analysis Tool

- Forex Trading Insights and Tips with ProTradingAssistant

- Stock Market Trend Forecasting Software

- Options Trading Strategies Optimizer

Are you a beginner in the world of trading and looking for the right tools to help you make informed decisions and minimize risks? Look no further! In this blog post, we will introduce you to the best trading analytics platforms and tools specifically designed for beginners. By incorporating these tools into your trading strategy, you can trade smarter and not riskier, ultimately increasing your chances of success in the market.

Best Trading Analytics Platform for Beginners

Starting your trading journey can be overwhelming, but with the right analytics platform, you can simplify the process and make more informed decisions. Look for a user-friendly platform that provides real-time market analysis and insights tailored for beginners. This platform should offer features such as customizable dashboards, educational resources, and intuitive tools to help you navigate the market with confidence.

Real-time Market Analysis Tool for Day Traders

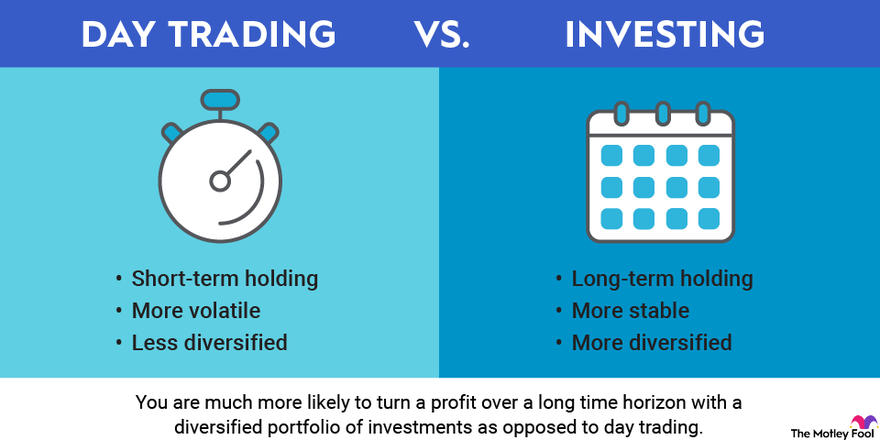

For day traders, having access to real-time market analysis is crucial for success. This tool will allow you to monitor market trends, identify trading opportunities, and make quick decisions based on current market data. With real-time analysis, you can stay ahead of market fluctuations and capitalize on short-term trading opportunities.

Trade Smarter: Use Stock Trader Risk Assessment Calculator

Advanced Risk Management Software for Investors

Investing in the stock market comes with inherent risks, but with advanced risk management software, you can mitigate potential losses and protect your investments. This software uses algorithms to analyze market conditions and customize risk management strategies based on your investment goals and risk tolerance. By implementing risk management software, you can trade with confidence and peace of mind.

Image courtesy of via Google Images

Swing Trading Strategies with ProTradingAssistant

Swing trading is a popular trading strategy for beginners looking to capitalize on short-term price movements. With ProTradingAssistant, you can access proven swing trading strategies that are easy to implement and tailored for novice traders. These strategies will help you identify entry and exit points, manage risk effectively, and maximize your profits in the market.

Long-term Investment Portfolio Optimizer

Building a successful long-term investment portfolio requires careful planning and optimization. Utilize a portfolio optimizer tool to diversify your investments, rebalance your portfolio, and align your investments with your financial goals. By optimizing your long-term investment portfolio, you can achieve sustainable growth and financial stability over time.

Image courtesy of via Google Images

Image courtesy of via Google Images

Technical Analysis Charts for Cryptocurrency Traders

For cryptocurrency traders, technical analysis is essential for making informed trading decisions. Access technical analysis charts that are specifically designed for cryptocurrency markets, providing you with insights into price trends, support and resistance levels, and potential market movements. By leveraging technical analysis charts, you can navigate the volatile crypto market with confidence.

Algorithmic Trading Automation Solutions

Automate your trading strategies with algorithmic trading solutions designed for beginners. These automation tools execute trades, manage risk, and optimize trading strategies based on predefined parameters. By automating your trading, you can minimize emotional decision-making, reduce human errors, and enhance the efficiency of your trading operations.

Image courtesy of via Google Images

Image courtesy of via Google Images

Profitable Trading Signals Provider

Gain access to profitable trading signals from a reputable provider to enhance your trading performance. These signals are generated by experienced traders and analysts, providing you with trade recommendations based on market trends and analysis. By following profitable trading signals, you can make informed trading decisions and increase your chances of success in the market.

| Stock Trader Risk Assessment Calculator | |

|---|---|

| Assessment Criteria | Scoring |

| Leverage Used | Low: 0-2, Medium: 3-5, High: 6-10 |

| Diversification of Portfolio | Low: 0-2, Medium: 3-5, High: 6-10 |

| Risk Tolerance | Low: 0-2, Medium: 3-5, High: 6-10 |

| Trading Frequency | Low: 0-2, Medium: 3-5, High: 6-10 |

| Overall Risk Score | 0-10 |

| Based on your overall risk score, here are our recommendations: | |

| Low Risk (0-3): Stick to conservative investments and avoid high-risk strategies | |

| Medium Risk (4-7): Diversify your portfolio and consider moderate risk strategies | |

| High Risk (8-10): Be cautious, reevaluate your risk tolerance, and consider seeking professional advice | |

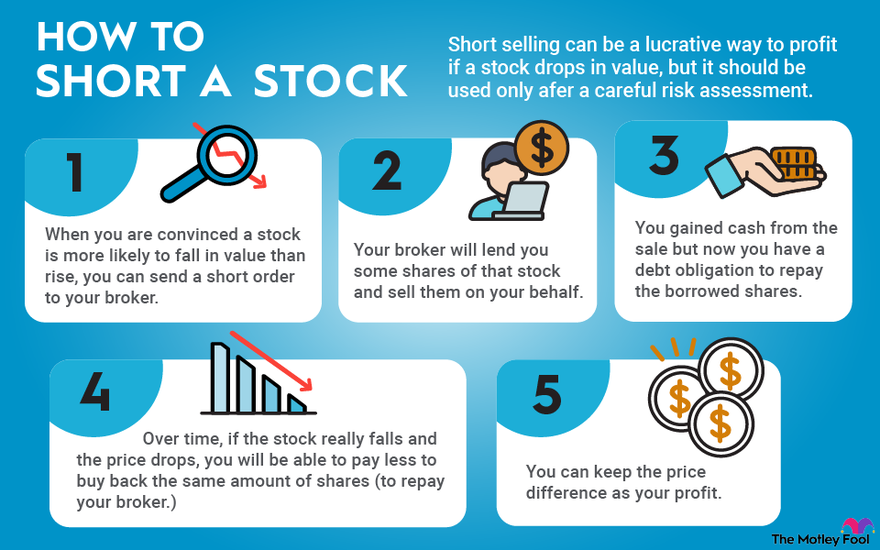

Risk Assessment Calculator for Stock Traders

Use a risk assessment calculator to evaluate your risk tolerance and determine the optimal position size for your trades. This calculator considers factors such as account size, risk tolerance, and stop-loss levels to help you manage risk effectively and protect your capital. By utilizing a risk assessment calculator, you can trade with a disciplined approach and safeguard your investments.

Image courtesy of via Google Images

Image courtesy of via Google Images

Personalized Trading Strategies Generator

Create personalized trading strategies that align with your trading goals and risk tolerance. A trading strategies generator allows you to customize your trading approach, set specific parameters, and test your strategies in a simulated environment. By tailoring your trading strategies to your individual preferences, you can enhance your trading performance and achieve consistent results in the market.

In-depth Market Trend Analysis Tool

Stay informed about market trends and developments with an in-depth market trend analysis tool. This tool provides you with comprehensive insights into market movements, sector performance, and macroeconomic indicators, helping you make well-informed trading decisions. By conducting thorough market trend analysis, you can adapt your trading strategy to changing market conditions and capitalize on emerging opportunities.

Image courtesy of via Google Images

Image courtesy of via Google Images

Forex Trading Insights and Tips with ProTradingAssistant

Gain valuable insights and tips for forex trading from ProTradingAssistant, a trusted resource for forex traders. Learn about market trends, trading strategies, and risk management techniques to enhance your forex trading skills. With expert guidance from ProTradingAssistant, you can navigate the complex forex market with confidence and improve your trading results.

Stock Market Trend Forecasting Software

Anticipate stock market trends and movements with trend forecasting software that leverages data analytics and predictive algorithms. This software analyzes historical market data, identifies patterns and trends, and generates forecasts for future market conditions. By using trend forecasting software, you can make proactive trading decisions and position yourself ahead of market trends.

Options Trading Strategies Optimizer

Optimize your options trading strategies with a specialized tool that caters to options traders. This optimizer tool analyzes options strategies, evaluates risk-reward ratios, and suggests adjustments to enhance your trading performance. By fine-tuning your options trading strategies, you can maximize profitability, minimize risks, and achieve consistent returns in the options market.

Start your trading journey on the right foot by incorporating these trading analytics platforms and tools into your trading arsenal. Trade smarter, not riskier, by leveraging the power of data, analysis, and automation to make informed decisions and maximize your trading success. Whether you are a beginner trader or an experienced investor, these tools will help you navigate the complexities of the market and achieve your financial goals. Embrace the opportunities that trading analytics can offer and elevate your trading game to new heights!

FAQ

How can a risk assessment calculator benefit stock traders?

Answer 1: A risk assessment calculator helps stock traders evaluate their risk tolerance, determine optimal position sizes, and manage risk effectively to protect their capital while making informed trading decisions.

What are the key features of a personalized trading strategies generator?

Answer 2: A personalized trading strategies generator allows traders to customize their trading approaches, set specific parameters, and test strategies in a simulated environment to align with individual preferences and improve trading performance.

How can algorithmic trading automation solutions benefit beginners in trading?

Answer 3: Algorithmic trading automation solutions help beginners automate trading strategies, execute trades efficiently, and manage risk based on predefined parameters to minimize emotional decision-making, reduce errors, and enhance trading efficiency.

Why is real-time market analysis essential for day traders?

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

Answer 4: Real-time market analysis is crucial for day traders to monitor market trends, identify trading opportunities, and make quick decisions based on current data to stay ahead of market fluctuations and capitalize on short-term trading opportunities.

Image courtesy of Valentin Antonucci via

Image courtesy of Valentin Antonucci via