Discover the secret to maximizing your stock portfolio with risk calculators – find out how to optimize your investments now!

Table of Contents

- Introduction: Why Use Tools to Handle Your Stocks?

- Understanding Stock Market Risks

- The Helpers: Risk Calculators for Smarter Decisions

- Starting Out Strong: Tools for Beginners

- Playing the Long Game: Portfolio Optimizers

- Quick Decisions: Tools for Day Trading

- Peeking into the Future: Trend Forecasters

- The Complete Package: All-in-One Analytics Platforms

- Staying Updated: Real-Time Analysis

- Making It Fun: Interactive Tools and Games

- Conclusion: Building Your Toolkit

- FAQs

Introduction: Why Use Tools to Handle Your Stocks?

Welcome to a world where we use special tools to make better choices with our stocks! We’ll learn about how using the right tools can help us.

Understanding Stock Market Risks

Before we jump into tools, let’s chat about the kinds of risks that come with buying and selling stocks.

Optimize Your Stocks with Risk Calculators

What is Risk in Stock Trading?

Risk means that sometimes things might not go the way we hope when we buy or sell stocks.

How Can We Measure Stock Risks?

Just like measuring how tall you are, we can measure risks in the stock market too!

The Helpers: Risk Calculators for Smarter Decisions

Have you ever wished for a magical calculator that could help you make smart decisions about buying and selling stocks? Well, that’s exactly what risk assessment calculators are – your very own math wizard for the stock market!

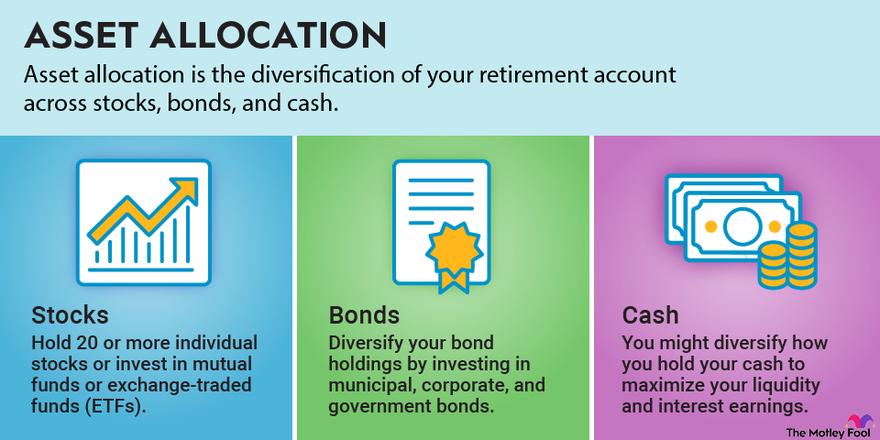

Image courtesy of www.fool.com via Google Images

What’s a Risk Calculator?

Think of a risk calculator as a special tool that crunches numbers and analyzes data to tell you how risky a particular stock can be. It’s like having a super-smart friend who can look into the future and warn you about potential dangers.

Why Investors Love Risk Calculators

Investors adore risk calculators because they offer a safety net for their hard-earned money. By using these calculators, investors can avoid making risky choices that could lead to big losses. It’s like having a shield that protects your finances from unexpected storms in the stock market.

Starting Out Strong: Tools for Beginners

When you’re just starting out in the world of trading stocks, it can feel overwhelming. Don’t worry! There are tools specially designed to help beginners like you get a strong start without feeling too confused.

Easy-to-Use Platforms for New Traders

Imagine these tools as friendly guides that hold your hand and show you the right path in the stock market adventure. They simplify complex concepts and present them in an easy-to-understand way so that you can make informed decisions without feeling lost.

Playing the Long Game: Portfolio Optimizers

Learn how to make your piggy bank grow over a long time with the right tools!

![]() Image courtesy of www.slidegeeks.com via Google Images

Image courtesy of www.slidegeeks.com via Google Images

What is a Portfolio Optimizer?

Think of this as a puzzle master that helps put your stock pieces in the perfect spots for the future.

Quick Decisions: Tools for Day Trading

Day traders need to think fast, and these tools help them do just that! Let’s explore how real-time market analysis tools can help day traders make quick decisions to stay ahead in the stock market.

The Need for Speed in Day Trading

Day trading is like a fast-paced race, where split-second decisions can make all the difference. Real-time market analysis tools act as the turbo boosters that help day traders navigate through the twists and turns of the stock market.

Peeking into the Future: Trend Forecasters

Have you ever wondered how some people seem to know what might happen in the stock market before it actually happens? Well, that’s where trend forecasters come in! These special tools are like fortune tellers for stocks, giving hints about what might come next.

| Risk Calculator | Description | Benefits |

|---|---|---|

| Value-at-Risk (VaR) | Measures the maximum potential loss over a specified time horizon at a given confidence level | Helps investors determine the amount of capital they could lose in adverse market conditions |

| Sharpe Ratio | Evaluates the risk-adjusted return of an investment by considering its volatility | Allows investors to compare the performance of different securities or portfolios |

| Sortino Ratio | Similar to the Sharpe Ratio, but only considers downside risk | Focuses on the potential for losses rather than overall volatility |

Image courtesy of www.fool.com via Google Images

Image courtesy of www.fool.com via Google Images

How Can Software Predict Stock Trends?

Imagine having a magical crystal ball that could show you the future of the stock market. trend forecasting software works a bit like that! It uses complex algorithms and historical data to analyze patterns in the stock market and make educated guesses about what might happen next.

By looking at how stocks have behaved in the past, these tools can help investors make smarter decisions about when to buy or sell, based on the likelihood of certain trends repeating themselves. While they can’t predict the future with 100% accuracy, trend forecasters give investors valuable insights to guide their choices.

So, if you want to stay ahead of the game and make informed decisions about your investments, keeping an eye on these trend forecasters can give you a peek into what the future might hold for the stock market!

The Complete Package: All-in-One Analytics Platforms

Let’s explore why some tools have it all, from risk checks to trend guesses, and why that’s super helpful.

Benefits of Using All-in-One Tools

Having a Swiss Army knife for stock trading means you’ve got lots of tools in one handy package!

Staying Updated: Real-Time Analysis

Understanding how to keep a close eye on the stock market at all times can give us an advantage when making decisions about our investments. Real-time market analysis is like having a friend who’s always watching the playground and telling you the latest news.

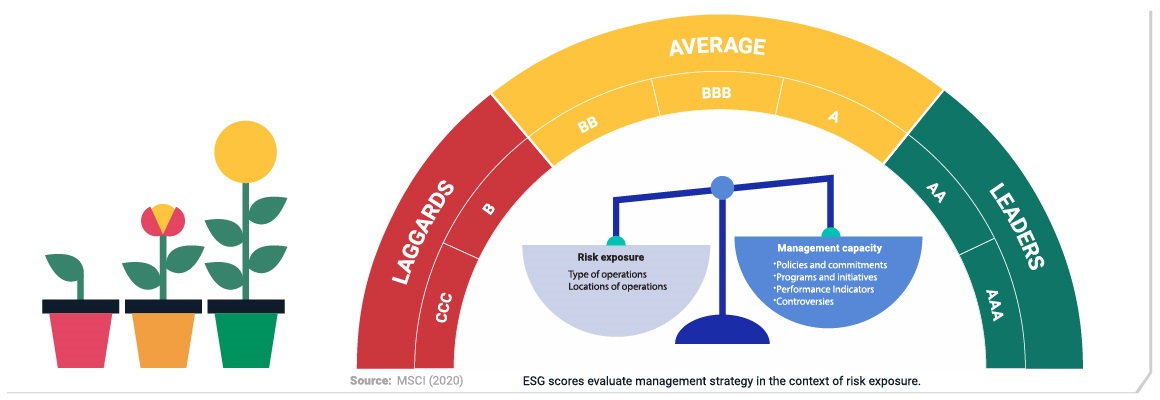

Image courtesy of www.msci.com via Google Images

Image courtesy of www.msci.com via Google Images

What Does Real-Time Analysis Mean?

Real-time analysis is all about getting up-to-the-minute information about what’s happening in the stock market. It’s like having a superhero power that lets you know instantly if something important is going on. By staying updated with real-time analysis, we can react quickly to changes and make smarter choices when buying or selling stocks.

Making It Fun: Interactive Tools and Games

Did you know learning about stocks could be fun too? There are tools that turn learning into a game.

Learn While Playing

Imagine playing a game where you learn how to be awesome at trading stocks – that’s what some tools offer!

Conclusion: Building Your Toolkit

As you embark on your journey into the world of trading stocks, remember that having the right tools at your disposal can make all the difference in your success. Building your toolkit is like assembling a box of superhero gadgets for your money – each tool serving a specific purpose to help you make informed decisions and navigate the unpredictable waters of the stock market.

Image courtesy of www.fool.com via Google Images

Image courtesy of www.fool.com via Google Images

From risk assessment calculators for stock traders to real-time market analysis tools for day traders, there is a wide array of resources available to help you optimize your stock investments. These tools act as your trusted sidekicks, guiding you through the complexities of the market and empowering you to make smart choices that align with your investment goals.

By incorporating advanced risk management software for investors and stock market trend forecasting software into your toolkit, you can enhance your decision-making process and minimize potential risks. Whether you’re a beginner looking for the best trading analytics platform or a seasoned investor seeking long-term investment portfolio optimizers, there is a tool out there tailored to meet your specific needs.

As you continue to explore the diverse range of tools and resources available to you, remember that knowledge is power. Educate yourself on the various tools at your disposal, experiment with different platforms, and find the ones that resonate with your trading style. By building a comprehensive toolkit that caters to your unique preferences and objectives, you’ll be better equipped to navigate the complexities of the stock market and achieve your financial goals.

FAQs

Why do I need to use these tools?

Using tools like risk assessment calculators and trend forecasting software can help you make better decisions when trading stocks. These tools provide valuable insights and analysis that can reduce the risks involved in stock trading, ultimately helping you protect and grow your investments.

Can these tools really predict what will happen?

While no tool can predict the future with absolute certainty, tools like stock market trend forecasting software use historical data and sophisticated algorithms to make educated guesses about future market trends. By analyzing patterns and trends, these tools can provide valuable information to help you make more informed decisions.

Are these tools only for adults?

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

No, these tools are not only for adults! While some stock trading tools may be more advanced and suited for experienced investors, there are also beginner-friendly tools designed to help younger traders learn and navigate the stock market. It’s never too early to start learning about investing and using tools to optimize your stock trading strategies.

Image courtesy of Anna Nekrashevich via

Image courtesy of Anna Nekrashevich via