Discover the secret strategies and expert tips from ProTradingAssistant to conquer the challenging Forex market like a pro!

Table of Contents

- Introduction to Trading Analytics Platforms

- Real-time Market Analysis Tools

- Advanced Risk Management Software

- Swing Trading Strategies with ProTradingAssistant

- Long-term Investment Portfolio Optimizer

- Technical Analysis Charts for Cryptocurrency Traders

- Algorithmic Trading Automation Solutions

- Profitable Trading Signals Provider

- Risk Assessment Calculator for Stock Traders

- Personalized Trading Strategies Generator

- In-depth Market Trend Analysis Tool

- Forex Trading Insights and Tips with ProTradingAssistant

- Stock Market Trend Forecasting Software

- Options Trading Strategies Optimizer

Introduction to Trading Analytics Platforms

Trading in the financial markets can be a daunting task, especially for beginners. However, with the right tools and resources at your disposal, you can gain an edge and make informed trading decisions. One such tool that can significantly benefit novice traders is a trading analytics platform. These platforms offer real-time market analysis, risk management tools, and personalized trading strategies, helping traders navigate the complexities of the market with confidence.

Master Forex Market with ProTradingAssistant’s Expert Tips

Real-time Market Analysis Tools

Day traders require up-to-the-minute information to capitalize on market movements quickly. Real-time market analysis tools provide traders with timely data, charts, and insights to identify trading opportunities and make informed decisions. These tools can track market trends, analyze price movements, and help traders stay ahead of the curve in a fast-paced trading environment.

Advanced Risk Management Software

Risk management is a crucial aspect of trading that often separates successful traders from the rest. Advanced risk management software empowers investors to assess and mitigate risks effectively, ensuring that their trading capital is protected. By setting stop-loss orders, calculating position sizes, and monitoring portfolio risk levels, traders can minimize losses and maximize profits over the long term.

Swing Trading Strategies with ProTradingAssistant

For traders looking to profit from short-term market swings, swing trading strategies can be highly lucrative. Platforms like ProTradingAssistant offer a range of tools and resources specifically tailored for swing traders, including trend analysis, entry and exit signals, and risk management features. By implementing proven swing trading strategies, traders can capitalize on market fluctuations and generate consistent profits.

Long-term Investment Portfolio Optimizer

Building a well-diversified long-term investment portfolio is essential for achieving financial goals and securing a stable financial future. An investment portfolio optimizer can help traders identify the right mix of assets based on their risk tolerance, investment horizon, and financial objectives. By optimizing their portfolio with the right mix of assets, traders can minimize risk, maximize returns, and achieve long-term investment success.

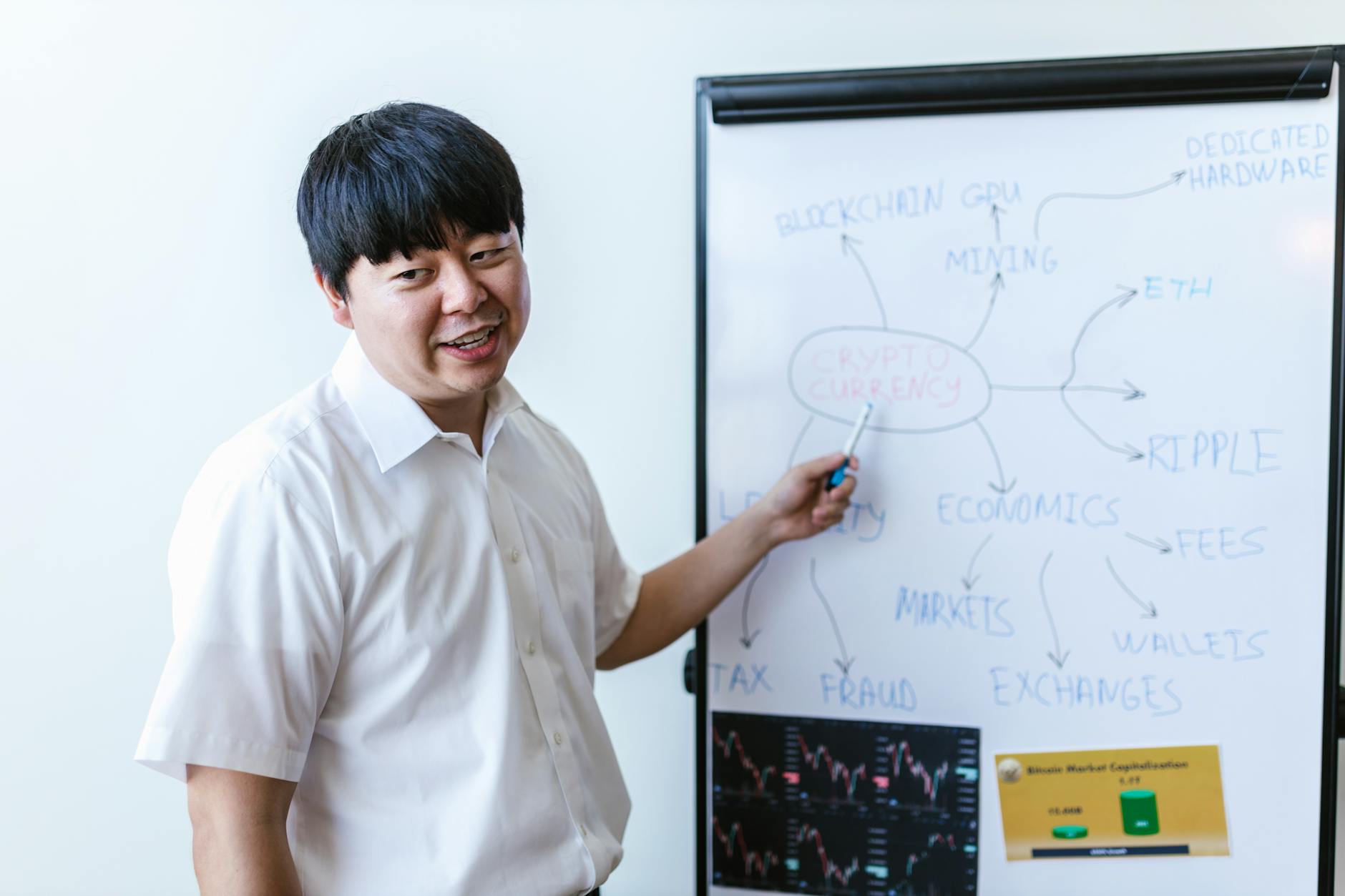

Technical Analysis Charts for Cryptocurrency Traders

Cryptocurrency trading can be highly volatile, making technical analysis charts an invaluable tool for traders looking to navigate this market successfully. These charts provide traders with visual representations of price movements, trend patterns, and key support and resistance levels, helping them make well-informed trading decisions. By analyzing technical indicators and chart patterns, cryptocurrency traders can enhance their trading strategies and capitalize on market opportunities.

Algorithmic Trading Automation Solutions

Algorithmic trading automation solutions streamline the trading process by executing trades based on predefined rules and algorithms. These solutions can help traders eliminate emotional biases, improve trade execution speed, and capitalize on market inefficiencies. By automating their trading strategies, traders can enhance their trading efficiency, reduce human errors, and optimize their trading performance.

Profitable Trading Signals Provider

Trading signals providers offer traders valuable insights into potential trading opportunities in the market. These signals are generated based on technical analysis, market trends, and trading algorithms, helping traders identify profitable entry and exit points. By following the signals provided by a reputable trading signals provider, traders can improve their trading accuracy, enhance their performance, and achieve consistent profitability in the market.

| Expert Tip | Description |

|---|---|

| Stay Informed | Regularly follow news and economic events that can impact currency markets. |

| Use Stop-Loss Orders | Implement stop-loss orders to minimize potential losses and protect your capital. |

| Practice Risk Management | Allocate only a small portion of your trading capital to each trade to manage risks effectively. |

| Embrace Technical Analysis | Utilize charts, indicators, and patterns to identify potential entry and exit points. |

| Develop a Trading Plan | Create a detailed plan outlining your trading strategy, goals, and risk tolerance levels. |

Risk Assessment Calculator for Stock Traders

Stock traders can benefit from using a risk assessment calculator to evaluate and manage the risk associated with their trades. These calculators help traders determine the potential risk and reward of a trade, calculate position sizes based on risk tolerance, and set stop-loss levels to protect their capital. By utilizing a risk assessment calculator, stock traders can make informed decisions, manage risk effectively, and improve their trading outcomes.

Personalized Trading Strategies Generator

Every trader has unique trading goals, risk tolerance, and investment preferences. A personalized trading strategies generator can help traders create customized trading plans tailored to their individual needs and objectives. By generating personalized trading strategies, traders can align their trading approach with their goals, maximize their trading success, and achieve consistent profitability in the market.

In-depth Market Trend Analysis Tool

Understanding market trends is essential for successful trading. An in-depth market trend analysis tool provides traders with comprehensive insights into market dynamics, trend formations, and potential trading opportunities. By analyzing market trends, traders can anticipate price movements, identify high-probability trade setups, and adjust their trading strategies accordingly to capitalize on market trends effectively.

Forex Trading Insights and Tips with ProTradingAssistant

Forex trading is one of the largest and most liquid financial markets globally, offering traders numerous opportunities to profit from currency fluctuations. ProTradingAssistant provides valuable insights, tips, and resources for forex traders, helping them navigate the complexities of the forex market with confidence. By leveraging expert guidance and industry-leading tools, forex traders can enhance their trading skills, improve their decision-making process, and achieve success in the forex market.

Stock Market Trend Forecasting Software

Stock market trend forecasting software utilizes data analysis, predictive algorithms, and technical indicators to forecast future price movements in the stock market. By analyzing historical price data and market trends, this software helps traders identify potential trend reversals, breakouts, and trade setups. By using stock market trend forecasting software, traders can anticipate market movements, make informed trading decisions, and optimize their trading strategies for maximum profitability.

Options Trading Strategies Optimizer

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

Options trading offers traders unique opportunities to profit from market volatility and price fluctuations. An options trading strategies optimizer helps traders identify the most suitable options strategies based on their market outlook, risk tolerance, and investment goals. By optimizing their options trading strategies, traders can enhance their trading outcomes, manage risk effectively, and capitalize on options trading opportunities with confidence.

How can ProTradingAssistant help me improve my forex trading skills?

ProTradingAssistant offers expert tips, real-time market analysis tools, and personalized trading strategies to enhance your forex trading performance and decision-making process.

Can beginners benefit from using trading analytics platforms?

Yes, trading analytics platforms provide beginners with valuable insights, risk management tools, and market analysis to help them navigate the forex market with confidence.

What are the benefits of using algorithmic trading automation solutions?

Algorithmic trading automation solutions streamline trading processes, eliminate emotional biases, and improve trade execution speed for traders looking to optimize their performance.

How can I stay updated on market trends and potential trading opportunities?

By following the insights, tips, and resources provided by ProTradingAssistant, you can stay informed about market trends, trading strategies, and profitable opportunities in the forex market.

Image courtesy of RDNE Stock project via

Image courtesy of RDNE Stock project via

[…] Introduction to the best trading analytics platform for beginners […]