Uncover the secrets to profitable cryptocurrency trading with our guide on mastering technical analysis for success in the market.

Table of Contents

- Best trading analytics platform for beginners

- Real-time market analysis tool for day traders

- Advanced risk management software for investors

- Swing trading strategies with ProTradingAssistant

- Long-term investment portfolio optimizer

- Technical analysis charts for cryptocurrency traders

- Algorithmic trading automation solutions

- Profitable trading signals provider

- Risk assessment calculator for stock traders

- Personalized trading strategies generator

- In-depth market trend analysis tool

- Forex trading insights and tips with ProTradingAssistant

- Stock market trend forecasting software

- Options trading strategies optimizer

- Conclusion

Are you a beginner in the world of cryptocurrency trading, looking to maximize your profits and minimize risks? Trading in the volatile cryptocurrency market can be challenging, but with the right tools and resources at your disposal, you can navigate through the ups and downs more effectively. In this guide, we will explore the essential tools and strategies that can help you excel in cryptocurrency trading, with a focus on technical analysis.

Best trading analytics platform for beginners

One of the first steps in your journey as a cryptocurrency trader is to choose the right trading analytics platform. A platform tailored for beginners can provide you with valuable insights into market trends, price movements, and potential trading opportunities. Look for features such as user-friendly interface, real-time data updates, and customizable charts for a holistic trading experience.

Real-time market analysis tool for day traders

Day traders thrive on quick decision-making based on real-time market data. A reliable market analysis tool can give you an edge in the fast-paced cryptocurrency market. Stay updated on price fluctuations, volume trends, and trading patterns to make informed decisions on your trades throughout the day.

Advanced risk management software for investors

Risk management is a crucial aspect of successful trading. Advanced risk management software can help you set stop-loss orders, track your portfolio performance, and assess potential risks associated with your trades. By implementing effective risk management strategies, you can protect your investments and minimize losses in volatile market conditions.

Image courtesy of www.amazon.com · In stock via Google Images

Swing trading strategies with ProTradingAssistant

Swing trading involves holding positions for a few days to weeks to capitalize on short to medium-term price movements. ProTradingAssistant offers swing traders sophisticated tools and analytics to identify potential entry and exit points, establish risk-reward ratios, and optimize their trading strategies for maximum profitability.

Long-term investment portfolio optimizer

For investors looking to build a long-term cryptocurrency portfolio, a portfolio optimizer can help tailor your investment strategy to achieve your financial goals. By analyzing historical data, market trends, and risk factors, this tool can assist in diversifying your portfolio and maximizing returns over time.

Image courtesy of www.amazon.com · In stock via Google Images

Image courtesy of www.amazon.com · In stock via Google Images

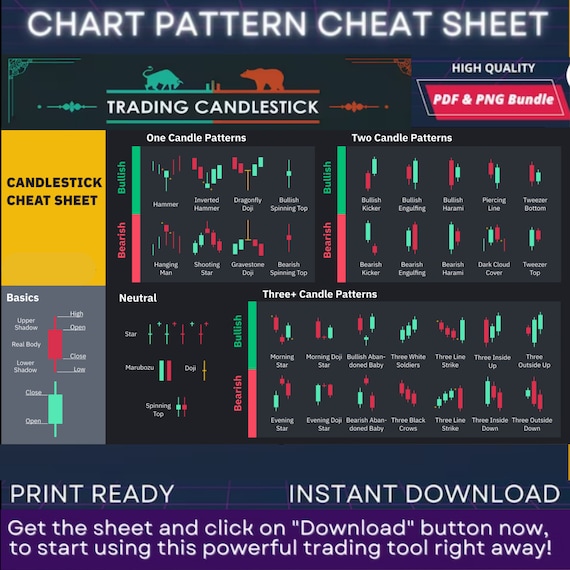

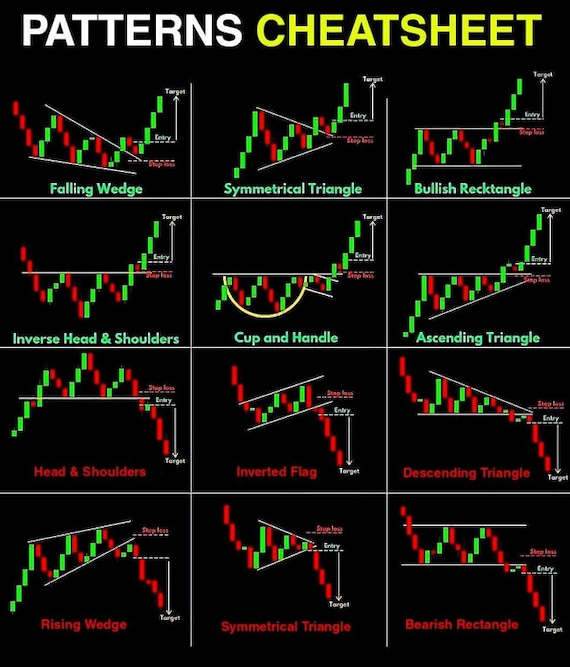

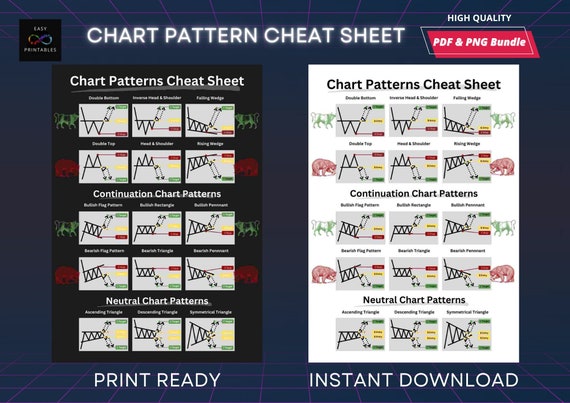

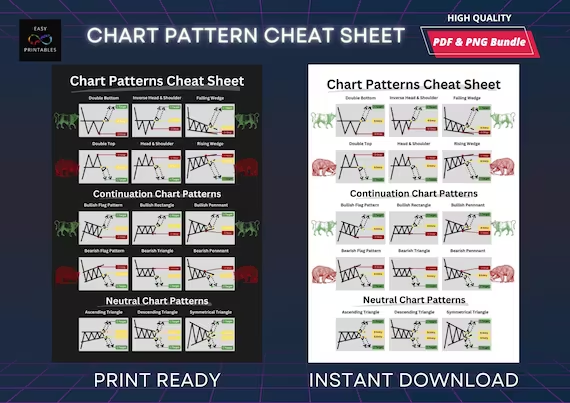

Technical analysis charts for cryptocurrency traders

Technical analysis is a foundational skill for successful cryptocurrency trading. Analyzing price charts, patterns, and indicators can provide valuable insights into market sentiment and potential future price movements. Utilize technical analysis charts to identify trends, support and resistance levels, and key entry and exit points for your trades.

Algorithmic trading automation solutions

Algorithmic trading automates the execution of trades based on pre-defined criteria and algorithms. By leveraging algorithmic trading automation solutions, cryptocurrency traders can remove emotions from their decision-making process, react quickly to market changes, and capitalize on trading opportunities 24/7.

Image courtesy of www.etsy.com via Google Images

Image courtesy of www.etsy.com via Google Images

Profitable trading signals provider

A trading signals provider offers expert insights and recommendations on potential profitable trading opportunities. By subscribing to a reputable trading signals service, you can access real-time trade alerts, market analysis, and trading strategies from experienced professionals to enhance your trading performance.

Risk assessment calculator for stock traders

Assessing and managing risk is essential in trading. A risk assessment calculator can help you quantify the potential risks associated with your trades, determine position sizing, and set appropriate risk management parameters to protect your capital and trading portfolio.

| Topic | Description |

|---|---|

| Introduction to Technical Analysis | Learn the basics of technical analysis for cryptocurrency trading. |

| Candlestick Patterns | Understand common candlestick patterns and what they signify. |

| Support and Resistance Levels | Identify key support and resistance levels in cryptocurrency charts. |

| Indicators and Oscillators | Explore popular technical indicators and oscillators for trading. |

| Trend Analysis | Learn how to identify trends and use them to make informed trading decisions. |

| Trading Strategies | Discover effective trading strategies based on technical analysis. |

| Risk Management | Understand the importance of risk management when trading cryptocurrencies. |

| Putting It All Together | Learn how to combine technical analysis tools to create a successful trading plan. |

Image courtesy of www.etsy.com via Google Images

Image courtesy of www.etsy.com via Google Images

Personalized trading strategies generator

Every trader has unique trading goals and preferences. A personalized trading strategies generator can help you create custom trading plans based on your risk tolerance, investment horizon, and trading style. Tailor your strategies to align with your financial objectives and trading preferences for a more targeted approach to cryptocurrency trading.

In-depth market trend analysis tool

An in-depth market trend analysis tool can provide comprehensive insights into market trends, sentiment, and dynamics affecting cryptocurrency prices. Stay ahead of the curve by studying market trends, analyzing trading volumes, and identifying emerging patterns to make informed trading decisions based on thorough market analysis.

Image courtesy of www.etsy.com · In stock via Google Images

Image courtesy of www.etsy.com · In stock via Google Images

Forex trading insights and tips with ProTradingAssistant

Forex trading offers a diverse range of trading opportunities in the global currency market. Gain valuable insights and tips from ProTradingAssistant to enhance your forex trading skills, optimize your trading strategies, and capitalize on forex market trends for profitable trading outcomes.

A Cryptocurrency Trader’s Guide to Technical Analysis

Stock market trend forecasting software

Stock market trend forecasting software utilizes advanced algorithms and predictive analytics to forecast future price movements of stocks. By leveraging this software, traders and investors can make data-driven decisions, anticipate market trends, and position themselves strategically in the stock market for optimal trading outcomes.

Options trading strategies optimizer

Options trading involves complex strategies and risk management techniques. An options trading strategies optimizer can help you evaluate different options trading scenarios, analyze potential outcomes, and optimize your options strategies for maximum profitability and risk mitigation.

Conclusion

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

Embark on your cryptocurrency trading journey armed with the right tools and resources to navigate the dynamic and fast-paced market with confidence. By incorporating trading analytics platforms, technical analysis tools, risk management software, and expert insights into your trading practices, you can chart a successful path to financial prosperity and trading excellence in the exciting world of cryptocurrency trading.

What is technical analysis in cryptocurrency trading?

Technical analysis involves analyzing price charts, patterns, and indicators to predict future price movements based on historical data.

Why is risk management important in cryptocurrency trading?

Risk management is crucial to protect your investments, minimize losses, and ensure long-term success in the volatile cryptocurrency market.

How can algorithmic trading automation benefit cryptocurrency traders?

Algorithmic trading automation helps traders execute trades based on pre-defined algorithms, removing emotions and improving efficiency in decision-making.

What tools and resources are essential for successful cryptocurrency trading?

Essential tools include trading analytics platforms, technical analysis charts, risk management software, and trading signals providers to enhance trading performance and profitability.

Image courtesy of Valentin Antonucci via

Image courtesy of Valentin Antonucci via