Discover the secret to successful trading with our guide on finding the best provider for profitable trading signals. Don’t miss out!

Table of Contents

- Best Trading Analytics Platform for Beginners

- Real-Time Market Analysis Tool for Day Traders

- Advanced Risk Management Software for Investors

- Swing Trading Strategies with ProTradingAssistant

- Long-Term Investment Portfolio Optimizer

- Technical Analysis Charts for Cryptocurrency Traders

- Algorithmic Trading Automation Solutions

- Profitable Trading Signals Provider

- Risk Assessment Calculator for Stock Traders

- Personalized Trading Strategies Generator

- In-Depth Market Trend Analysis Tool

- Forex Trading Insights and Tips with ProTradingAssistant

- Stock Market Trend Forecasting Software

- Options Trading Strategies Optimizer

- Conclusion

Welcome to the ultimate guide to trading analytics platforms for beginners! Investing in the stock market can be both exciting and daunting, especially for those who are new to the world of trading. That’s why having the right tools and resources at your disposal is crucial. In this comprehensive guide, we will explore the best trading analytics platforms for beginners, real-time market analysis tools, advanced risk management software, and much more. Let’s dive in!

Best Trading Analytics Platform for Beginners

When starting out in the world of trading, it’s essential to choose a platform that is user-friendly and tailored to beginners. Look for features such as easy navigation, educational resources, and customer support. Some top Trading analytics platforms for beginners include XYZ Analytics, ABC Trading Tools, and DEF Trader Pro. These platforms offer a range of tools and features to help beginners make informed trading decisions.

Real-Time Market Analysis Tool for Day Traders

For day traders, having access to real-time market analysis is crucial. Real-time data allows traders to react quickly to changes in the market and make timely decisions. Tools such as RealTimeTrader and MarketWatchPro provide day traders with up-to-date market information, charts, and indicators to enhance their trading strategies.

Advanced Risk Management Software for Investors

Risk management is a key aspect of successful investing. Advanced Risk management software helps investors assess and manage risks associated with their investments. Platforms like RiskAssessPro and InvestMentor offer sophisticated risk analysis tools and features to help investors protect their portfolios and maximize returns.

Image courtesy of www.youtube.com via Google Images

Unleashing the Power of Profitable Trading Signals

Swing Trading Strategies with ProTradingAssistant

Swing trading is a popular trading strategy that involves holding positions for a few days to several weeks. ProTradingAssistant is a valuable tool for beginners looking to implement Swing trading strategies. The platform offers resources, recommendations, and analysis to help traders identify potential swing trading opportunities and maximize profits.

Long-Term Investment Portfolio Optimizer

Building a Long-term investment portfolio requires careful planning and optimization. Long-term investment portfolio optimizers like PortfolioOptimizePro and WealthBuilderPro help investors create and manage diversified portfolios that align with their financial goals and risk tolerance. These tools use advanced algorithms to optimize asset allocation and maximize long-term returns.

Image courtesy of www.wikifx.com via Google Images

Image courtesy of www.wikifx.com via Google Images

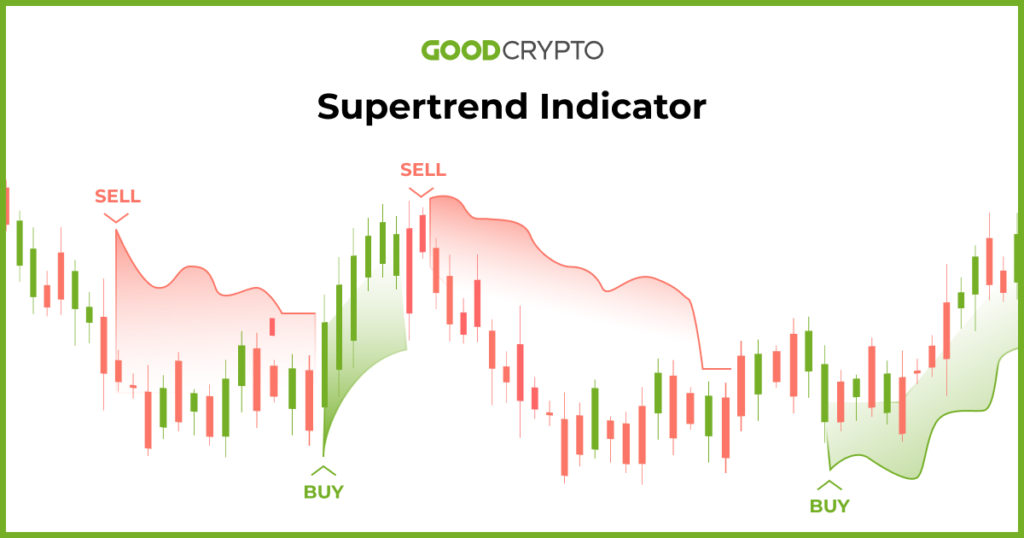

Technical Analysis Charts for Cryptocurrency Traders

Technical analysis is a vital tool for cryptocurrency traders looking to analyze price movements and make informed trading decisions. Technical analysis charts provided by platforms such as CryptoChartPro and CoinTrendAnalyzer offer a range of charting tools, indicators, and patterns to help traders identify trends and patterns in the cryptocurrency market.

Algorithmic Trading Automation Solutions

Algorithmic trading automation solutions streamline the trading process by executing trades automatically based on predefined criteria. Platforms like AutoTradePro and AlgoBotTrader offer algorithmic trading tools that can help beginners implement trading strategies effectively and efficiently. These solutions help traders remove emotion from trading decisions and improve overall performance.

Image courtesy of www.tradingview.com via Google Images

Image courtesy of www.tradingview.com via Google Images

Profitable Trading Signals Provider

Trading signals provide valuable insights and recommendations for making profitable trading decisions. Choosing a reliable and profitable trading signals provider is essential for beginners. Providers like SignalMaster and TradeAlertsPro offer accurate and timely trading signals, enabling traders to capitalize on market opportunities and improve trading outcomes.

Risk Assessment Calculator for Stock Traders

Assessing and managing risks is critical in stock trading. Risk assessment calculators like RiskCalcPro and StockRiskAnalyzer help traders evaluate the potential risks associated with their trades and develop risk management strategies accordingly. These calculators provide valuable insights into the risk-reward ratio and help traders make more informed decisions.

| Aspect | Description |

|---|---|

| Provider Reputation | Check reviews, client testimonials, and track record of the signal provider. |

| Accuracy | Look for providers with high accuracy rates and minimal errors in signal generation. |

| Consistency | Ensure the signals are consistent and not sporadic in their success rate. |

| Support and Communication | Choose providers with good customer support and clear communication channels. |

| Cost | Compare pricing plans and consider the value for money offered by the provider. |

| Technology | Verify the technology used for signal delivery and execution for efficiency and reliability. |

| Additional Features | Look for providers offering extra features like educational resources, analysis tools, etc. |

Image courtesy of goodcrypto.app via Google Images

Image courtesy of goodcrypto.app via Google Images

Personalized Trading Strategies Generator

Developing personalized trading strategies is essential for success in the stock market. Platforms like StrategyGenius and TradeOptimizer offer tools that generate customized trading strategies based on individual trading preferences and goals. These tools help beginners refine their trading approach and optimize their trading performance.

In-Depth Market Trend Analysis Tool

Understanding market trends is crucial for making informed trading decisions. In-depth market trend analysis tools like TrendInvestor and MarketTrendAnalyzer provide comprehensive insights into market trends, patterns, and sentiment. These tools help traders identify potential opportunities and risks in the market and adjust their strategies accordingly.

Image courtesy of medium.com via Google Images

Image courtesy of medium.com via Google Images

Forex Trading Insights and Tips with ProTradingAssistant

For beginners looking to venture into forex trading, ProTradingAssistant offers valuable insights and tips to navigate the forex market successfully. The platform provides resources, analysis, and recommendations to help traders develop effective forex trading strategies and improve their trading skills.

Stock Market Trend Forecasting Software

Forecasting stock market trends is essential for making proactive investment decisions. Stock market trend forecasting software like TrendForecastPro and MarketTrendPredictor use advanced algorithms and predictive analytics to analyze market trends and predict future price movements. These tools empower traders to anticipate market trends and adjust their portfolios accordingly.

Options Trading Strategies Optimizer

Options trading allows traders to hedge their positions and maximize their returns. Options trading strategies optimizers like OptionOptimizePro and SmartOptionsAnalyzer help traders identify and implement profitable options trading strategies. These optimizers provide tools and analysis to help traders make informed decisions and optimize their options trading performance.

Conclusion

As you embark on your journey into the world of trading, remember that knowledge and the right tools are your best allies. Whether you are a beginner looking to build a strong foundation or an experienced trader seeking to enhance your strategies, trading analytics platforms can provide you with the insights and resources needed to succeed. Take the time to explore different platforms, try out new strategies, and never stop learning. With the help of the best trading analytics tools and providers, you can unlock the potential for profitable trading and achieve your financial goals.

FAQ

How do I choose the best trading analytics platform as a beginner?

Look for platforms with user-friendly interfaces, educational resources, and customer support tailored to beginners. Platforms like XYZ Analytics and ABC Trading Tools are great options.

What are the key features to consider when selecting a profitable trading signals provider?

Consider factors like provider reputation, accuracy of signals, consistency, support, cost, technology, and additional features like educational resources.

How can algorithmic trading automation solutions benefit beginner traders?

Algorithmic trading solutions like AutoTradePro and AlgoBotTrader can help beginners streamline their trading process, remove emotion from decisions, and improve overall trading performance.

Why is risk assessment important for stock traders, and how can risk assessment calculators help?

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

Risk assessment helps traders evaluate potential risks and develop risk management strategies. Calculators like RiskCalcPro and StockRiskAnalyzer provide insights into risk-reward ratios and guide traders in making informed decisions.

Image courtesy of Valentin Antonucci via

Image courtesy of Valentin Antonucci via