Discover the secrets of successful trading with advanced algorithms. Learn how to automate your strategies and master the market with precision.

Table of Contents

- Real-time market analysis tool for day traders

- Advanced risk management software for investors

- Swing trading strategies with ProTradingAssistant

- Long-term investment portfolio optimizer

- Technical analysis charts for cryptocurrency traders

- Algorithmic trading automation solutions

- Profitable trading signals provider

- Risk assessment calculator for stock traders

- Personalized trading strategies generator

- In-depth market trend analysis tool

- Forex trading insights and tips with ProTradingAssistant

- Stock market trend forecasting software

- Options trading strategies optimizer

Are you ready to take your trading game to the next level? The world of trading can be overwhelming, especially for beginners. But fear not, because with the right tools and strategies, you can navigate the markets with confidence and success. In this blog post, we will explore the best trading analytics platform for beginners and how you can leverage its features to optimize your trading experience.

Real-time market analysis tool for day traders

One of the key components of successful trading is staying informed about market trends and fluctuations in real-time. A real-time market analysis tool can be a game-changer for day traders, allowing them to make quick and informed decisions based on up-to-the-minute data. With this tool, you can track market movements, identify patterns, and spot opportunities as soon as they arise. By utilizing this tool effectively, day traders can stay ahead of the curve and maximize their profits.

Advanced risk management software for investors

risk management is crucial in trading, as it helps mitigate potential losses and protect your investments. With advanced risk management software, investors can assess their risk tolerance, set stop-loss orders, and manage their portfolio more effectively. By integrating this software into your trading strategy, you can make more informed decisions and minimize the impact of market volatility on your investments.

Swing trading strategies with ProTradingAssistant

Swing trading is a popular trading strategy that involves holding a position for a few days to a few weeks to capitalize on short- to medium-term market trends. With ProTradingAssistant, beginners can access a wealth of swing trading strategies and insights to help them navigate the market with confidence. Whether you’re looking to capture quick gains or ride out longer trends, ProTradingAssistant can provide you with the tools and resources you need to succeed in swing trading.

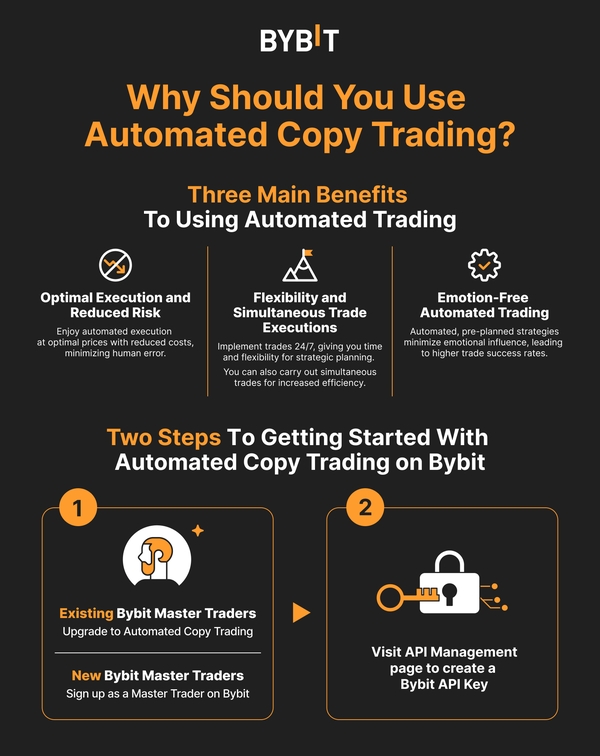

Image courtesy of learn.bybit.com via Google Images

How to Automate Your Trading with Cutting-Edge Algorithms

Long-term investment portfolio optimizer

Building a long-term investment portfolio requires careful planning and optimization. With the help of a portfolio optimizer tool, you can analyze your assets, diversify your investments, and maximize your returns over time. By leveraging this tool, beginners can construct a well-balanced and resilient portfolio that can weather market fluctuations and grow steadily over the long term.

Technical analysis charts for cryptocurrency traders

Cryptocurrency trading can be volatile and unpredictable, making technical analysis charts essential for traders looking to make informed decisions. By studying patterns, trends, and indicators on technical analysis charts, cryptocurrency traders can gain valuable insights into market behavior and potential price movements. Whether you’re a novice or experienced trader, utilizing these charts can help you navigate the complex world of cryptocurrency trading with confidence.

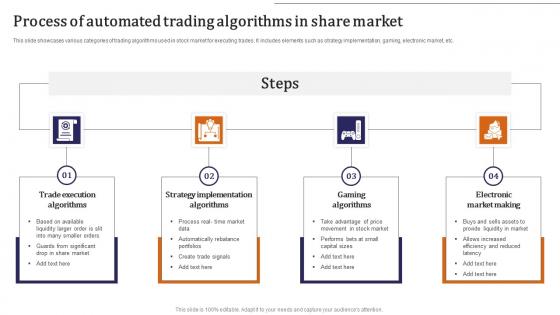

Algorithmic trading automation solutions

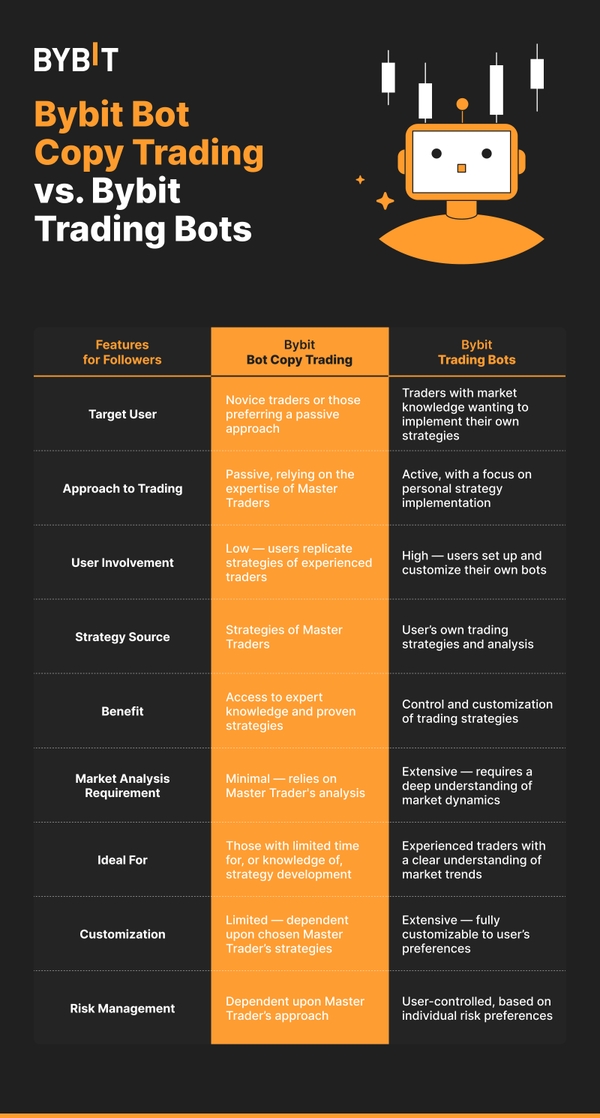

Algorithmic trading has revolutionized the way traders operate in the market, allowing for automated execution of trades based on predefined criteria. With algorithmic trading automation solutions, beginners can take advantage of sophisticated algorithms to execute trades efficiently and accurately. By setting up automated trading strategies, you can eliminate emotional biases, reduce manual errors, and capitalize on market opportunities in real-time.

Profitable trading signals provider

trading signals are invaluable resources for traders looking to make informed decisions about their investments. A profitable trading signals provider can deliver timely and accurate signals that can guide your trading strategy and enhance your profitability. By following these signals, beginners can learn from experienced traders, identify potential opportunities, and make smarter investment choices in the market.

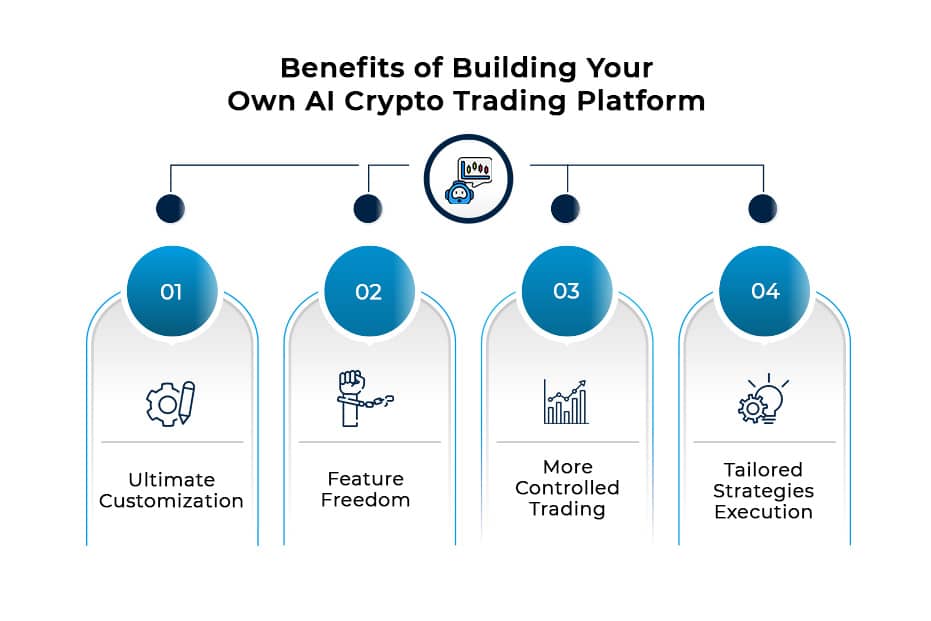

Image courtesy of www.antiersolutions.com via Google Images

Image courtesy of www.antiersolutions.com via Google Images

Risk assessment calculator for stock traders

Assessing and managing risk is a fundamental aspect of successful trading. With a risk assessment calculator, stock traders can evaluate their exposure to risk, set appropriate risk management parameters, and make informed decisions about their trades. By understanding and quantifying risk, you can protect your investments, preserve your capital, and navigate the stock market with confidence.

| Topic | Description |

|---|---|

| Introduction | Overview of algorithmic trading and its benefits |

| Market Analysis | Understanding market trends and patterns |

| Algorithm Development | Creating effective trading algorithms |

| Backtesting | Evaluating algorithm performance using historical data |

| Execution | Implementing algorithms in live trading environments |

| Risk Management | Strategies for minimizing trading risks |

Personalized trading strategies generator

Every trader is unique, with their own risk tolerance, investment goals, and trading preferences. A personalized trading strategies generator can help beginners create tailored strategies that align with their individual needs and objectives. By leveraging this generator, you can develop a customized trading plan that reflects your style, preferences, and risk appetite, setting you up for success in the market.

Image courtesy of learn.bybit.com via Google Images

Image courtesy of learn.bybit.com via Google Images

In-depth market trend analysis tool

Market trends can provide valuable insights into future price movements and market behavior. An in-depth market trend analysis tool can help traders identify patterns, trends, and signals that can inform their trading decisions. By utilizing this tool, beginners can stay ahead of market trends, anticipate potential changes, and position themselves strategically to capitalize on emerging opportunities.

Forex trading insights and tips with ProTradingAssistant

Forex trading can be complex and challenging, especially for beginners entering the market. With ProTradingAssistant, you can access a wealth of insights, tips, and resources to enhance your forex trading experience. Whether you’re looking to learn new strategies, understand market dynamics, or improve your trading skills, ProTradingAssistant can provide you with the guidance and support you need to succeed in the forex market.

Image courtesy of www.slideteam.net via Google Images

Image courtesy of www.slideteam.net via Google Images

Stock market trend forecasting software

Forecasting market trends is essential for traders looking to anticipate changes in stock prices and make informed investment decisions. Stock market trend forecasting software can analyze historical data, predict future trends, and help traders stay ahead of market movements. By incorporating this software into your trading strategy, you can gain a competitive edge, make smarter decisions, and maximize your profits in the stock market.

Options trading strategies optimizer

Options trading offers a range of opportunities for investors to hedge their positions, generate income, and maximize their returns. With an options trading strategies optimizer, beginners can explore different strategies, assess risk-reward ratios, and optimize their options trading activities. By utilizing this tool effectively, you can enhance your understanding of options trading, diversify your portfolio, and achieve your investment goals.

In conclusion, mastering the market involves leveraging the best trading analytics platform and tools to optimize your trading experience. By harnessing the power of real-time market analysis, advanced risk management, trading strategies, and automation solutions, beginners can navigate the markets with confidence and success. Whether you’re a day trader, investor, cryptocurrency trader, or forex trader, incorporating these tools and strategies into your trading routine can help you achieve your financial goals and maximize your returns in the market.

FAQs

Question 1: How can algorithmic trading help beginners improve their trading performance?

Answer 1: Algorithmic trading can help beginners by automating trading strategies, minimizing emotional biases, and executing trades based on predefined criteria, leading to more efficient and accurate trades.

Question 2: What are the benefits of using a personalized trading strategies generator?

Answer 2: A personalized trading strategies generator can help beginners create tailored strategies that align with their individual needs and objectives, setting them up for success in the market.

Question 3: How can a real-time market analysis tool benefit day traders?

Answer 3: A real-time market analysis tool can help day traders stay informed about market trends and fluctuations in real-time, enabling them to make quick and informed decisions based on up-to-the-minute data.

Question 4: Why is risk management crucial in trading?

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

Answer 4: Risk management is crucial in trading as it helps mitigate potential losses, protect investments, and minimize the impact of market volatility, allowing traders to make more informed decisions and preserve their capital.

Image courtesy of Pavel Danilyuk via

Image courtesy of Pavel Danilyuk via