Unlock the secrets of successful swing trading with these 7 essential steps – your ticket to financial freedom awaits!

Table of Contents

Introduction to Swing Trading

Imagine being a stock market detective, solving puzzles and catching opportunities to make money swiftly. swing trading strategies offer you that adventure in the world of buying and selling stocks. This exciting approach involves holding onto stocks for a short time to capture the ‘swing’ in the market trend.

What is Swing Trading?

Swing trading is like stepping into a thrilling maze of stocks where traders aim to profit from the ups and downs of the market. It’s a quick-paced game where you don’t wait around for years to see your investments grow; instead, you look for opportunities to make money in a matter of days or weeks.

Why Swing Trade?

The charm of swing trading lies in its ability to provide faster profits than traditional long-term investments. It’s like having a mystery to solve every day, trying to predict which way a stock might move. The thrill of uncovering profitable trades can be both challenging and rewarding, making swing trading an appealing choice for adventurous investors.

Getting Ready to Swing Trade

Before jumping into swing trading, it’s essential to equip yourself with the right tools to guide your decisions. Think of using a personalized trading strategies generator as having a trading sidekick by your side. This tool can help you tailor your strategies to your preferences and risk tolerance. Additionally, incorporating advanced risk management software is like having a shield to protect your investments from potential market fluctuations.

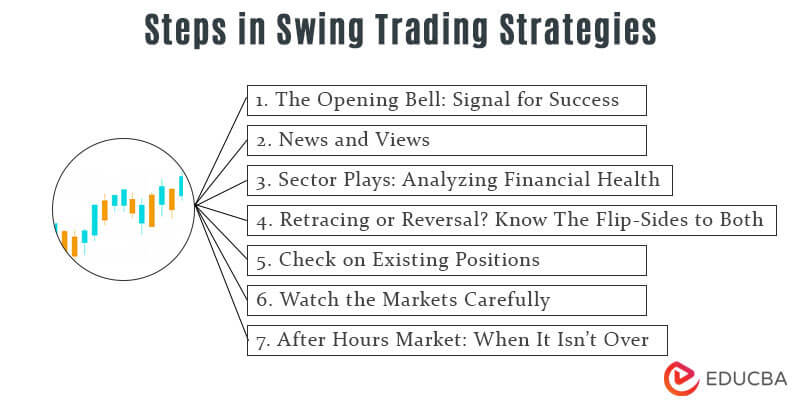

7 Steps to Master Swing Trading

The Basics of Swing Trading

Are you too busy to day trade? Is day trading too fast and risky for you? Well, swing trading might be the perfect solution for you. In this video by Humboldt Trader, the topic of how to start swing trading is discussed. Swing trading involves taking trades that may last days, weeks, or even months to develop. It is ideal for individuals who are working full-time, parents, or part-time traders. While swing trading requires more time for research, it allows for less screen time compared to day trading. However, it also exposes traders to overnight market risks.

How to Start Swing Trading

When starting to swing trade, it is essential to analyze from the bigger time frames, especially focusing on the daily and weekly charts. By analyzing key support and resistance levels on these charts, traders can identify potential entry and exit points for their trades. It is crucial to understand the macro environment changes and news that may impact swing trading decisions. By using wider risk levels, swing traders set themselves up for potentially bigger rewards.

Timing Your Entries and Exits

Timing entry and exit points in swing trading is crucial for success. By identifying major support and resistance levels on the daily and weekly charts, traders can plan their trades effectively. Whether looking for short entries at downtrend retests or breakdowns of key levels, having a clear strategy is key. Risk management is also essential in swing trading, with a focus on maintaining a positive risk-reward ratio.

Understanding Fundamentals

In swing trading, knowing the fundamentals of the stocks or assets being traded is crucial. Understanding earning states, FDA approvals, and other news related to the stocks can help traders make more informed decisions. Fundamental research becomes more important in swing trading compared to day trading, especially when holding positions for longer periods.

Conclusion

Swing trading offers a viable alternative to day trading for individuals with busy schedules or those looking for less screen time. By analyzing larger time frames, timing entries and exits effectively, understanding fundamentals, and managing risks appropriately, swing traders can increase their chances of success in the financial markets.

Understanding the Risks

While swing trading can be an exciting adventure, it’s crucial to acknowledge the risks involved. Every superhero faces challenges, and in the world of trading, being prepared can make a significant difference. Understand that risks are a part of the journey, but with proper risk management strategies in place, you can navigate the market with more confidence.

Developing Your Swing Trading Strategy

Creating a successful swing trading strategy is like crafting a plan to find hidden treasure in the stock market. It requires thought, research, and a personal touch to guide you towards profitable trades. Here are some steps to help you develop your own swing trading strategy:

Image courtesy of www.myfinopedia.com via Google Images

Finding Your Style

Just like picking your favorite ice cream flavor, choosing a swing trading style that resonates with you is essential. Consider whether you prefer fast-paced, short-term trades or more patient, long-term investments. Your style should align with your risk tolerance and trading goals.

Using the Best Maps

For beginners, navigating the stock market can be daunting. That’s where a user-friendly trading analytics platform comes in handy. These platforms provide valuable insights and tools to help you make informed decisions. Think of them as your trusted guides, leading you towards profitable opportunities.

Analyzing the Market

When it comes to swing trading, analyzing the market is like trying to predict the weather for your next picnic. Just like you check the forecast to see if it’s going to be sunny or rainy, traders use software to predict if stocks are going to go up (sunny/profitable) or down (rainy/not so good).

Learning the Weather Patterns of Stocks

Learning to analyze the market involves looking for patterns in stock prices. It’s almost like trying to guess if it will rain by looking at clouds in the sky. Just as certain cloud formations can indicate the likelihood of rain, certain patterns in stock prices can signal whether a stock is about to rise or fall.

Choosing Stocks to Swing Trade

When it comes to swing trading, one of the most important decisions you’ll make is choosing the right stocks to trade. It’s a bit like making a perfect sandwich – you want to pick the best ingredients to create a delicious meal. To help you with this process, there are signals provided by experts in the field that can guide you in selecting the most promising stocks.

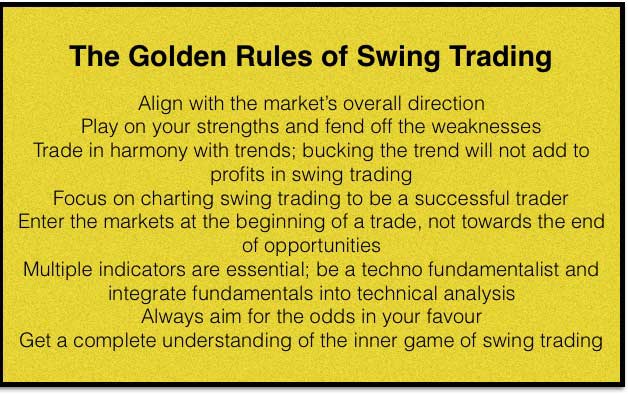

Image courtesy of www.educba.com via Google Images

Image courtesy of www.educba.com via Google Images

Listening for the Signal

These signals act as secret messages that give traders insights into which stocks are likely to be profitable. Just like how a treasure map leads you to hidden riches, these signals point you in the direction of stocks that have the potential to swing in your favor. By paying attention to these signals and doing your homework, you can make informed decisions on which stocks to include in your trading portfolio.

| Step | Description |

|---|---|

| 1 | Understand Market Trends |

| 2 | Identify Entry and Exit Points |

| 3 | Use Technical Analysis |

| 4 | Set Stop-Loss Orders |

| 5 | Practice Proper Risk Management |

| 6 | Keep Emotions in Check |

| 7 | Continuously Educate Yourself |

Executing Trades

Executing trades is the thrilling moment where you get to put your strategy into action and make things happen in the stock market. It’s like the starting signal at a race, where you’re all set to zoom off and chase your goals.

Putting the Plan into Action

Imagine your swing trading strategy as a game plan in a soccer match. You need to know what moves to make, when to make them, and how to score that winning goal (or in this case, make a profit).

When it’s time to execute a trade, all the preparation you’ve done, from choosing the right tools to analyzing the market, comes into play. You follow your plan step by step, just like following a recipe to make your favorite dish.

Managing Risk

Managing risk is an essential part of swing trading, just like wearing a helmet while skateboarding. It doesn’t take away from the thrill of the experience; it simply makes it safer. In the world of investing, risk management software is like your protective gear, ensuring that even if things don’t go as planned, you’re safeguarded.

Image courtesy of www.educba.com via Google Images

Image courtesy of www.educba.com via Google Images

Using Your Helmet

When traders use advanced risk management software, they are essentially putting on their investment helmet. This software helps them set limits on how much they are willing to risk on each trade, ensuring that they don’t expose themselves to excessive losses. It’s like having a safety net that prevents them from falling too hard if the market takes a downward turn.

Reviewing and Improving

After making some swing trades, it’s essential to take a step back and review your performance. This process is crucial for learning and improving your skills in swing trading. Just like studying for a big test, analyzing your trades can help you see what worked well and what could be done better.

Learning from the Past

One valuable way to improve your swing trading strategies is by using tools like ProTradingAssistant. This platform can help you review your past trades and analyze which strategies were most successful. It’s like a football team watching replays of their games to prepare better for the next match.

By reflecting on your past trades, you can identify patterns, trends, and mistakes that can guide your future decisions. Learning from your experiences is a key part of becoming a successful swing trader.

Final Thoughts on Mastering Swing Trading

Mastering swing trading can be an exciting journey filled with ups and downs, much like a thrilling adventure in the stock market. By following the steps outlined above and using the right tools like a personalized trading strategies generator and staying on top of stock market trends, you can increase your chances of success and potentially earn profits faster than traditional investing methods.

Image courtesy of www.investors.com via Google Images

Image courtesy of www.investors.com via Google Images

Remember, just like any skill, practice makes perfect. The more you trade and analyze your past trades using tools like ProTradingAssistant, the more you’ll learn and improve your strategies for future trades.

So, buckle up, put on your trading cape, and get ready to embark on an exciting journey into the world of swing trading. With dedication, perseverance, and the right tools by your side, you can become a successful swing trader and unlock the potential for financial growth. Happy trading!

FAQs

What is the best time to swing trade?

The best time to swing trade is when the stock market shows clear trends or movements that present opportunities for potential profits. It’s like catching a wave at the beach – you want to jump in at the right time for a smooth ride to the shore.

How much money do I need to start swing trading?

You don’t need a lot of money to start swing trading, but it’s important to have enough to comfortably invest in stocks without putting all your savings at risk. Think of it like having enough money to buy ingredients for a sandwich – you want to have just the right amount to make a tasty meal.

Can I swing trade if I’m still in school?

Every day 87,122 people use this Bizarre “Tap Water Ritual” To Rapidly Dissolve Fat

Are You Struggling to Lose Weight, See this Simple Solution!

Yes, you can swing trade even if you’re still in school! It’s a great way to learn about the stock market and financial skills while having fun. Just like how you balance schoolwork with hobbies, swing trading can be a rewarding adventure alongside your studies.

Image courtesy of Giallo via

Image courtesy of Giallo via